Invest in

Samco Active Momentum Fund

(An open-ended equity scheme following momentum theme)

Samco Active Momentum Fund is India’s 1st active momentum fund that aims in invests in stocks that are showing momentum characteristics using a proprietary momentum-seeking algorithm to generate superior risk adjusted returns.

Samco Active Momentum Fund

(An open-ended equity scheme following momentum theme)Samco Active Momentum Fund is India’s 1st active momentum fund that aims in invests in stocks that are showing momentum characteristics using a proprietary momentum-seeking algorithm to generate superior risk adjusted returns.

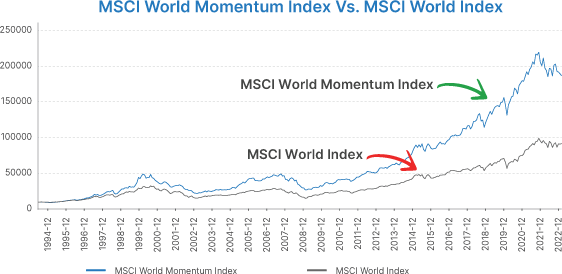

Momentum is one of the most persistent factor to generate excess returns in all assets be it equity, commodity and forex and over 215+ years of history.

Momentum is one of the most persistent factor to generate excess returns in all assets be it equity, commodity and forex and over 215+ years of history.