What is SIP (Systematic Investment Plan)?

There is a lot of confusion among the investors about what is a Systematic Investment Plan(SIP)? Most investors think SIP is a kind of mutual fund scheme, but it is only a method to invest in a mutual fund.

Have you heard the saying that little drops of water make the mighty ocean? It implies, metaphorically, that small thing have a huge impact. Small sums can lead to great things one day. This saying reflects how SIPs work.

In this article, you will learn:

- What is SIP?

- Benefits of SIP

- Who should Invest in SIP?

- Let's take an example to understand SIP

What is SIP(Systematic Investment Plan)?

In a SIP you can invest the same amount of money at regular intervals. It could be once a month, once a quarter, or even half-yearly.

SIP has made an investment in the mutual fund so easy that now investors can start investing as low as ₹100 so now investors prefer to do SIP instead of doing lumpsum. With the help of SIP, investors don’t need to worry about investing a large amount in the mutual fund at once anymore.

Benefits of SIP

- Creates Investment Disciplines: SIP helps to create a disciplined investment habit. Once the investor sets up a SIP, a fixed amount gets debited every month. Investors must set aside the fixed amount every month in their bank account for investment through SIP.

- Easily Affordable: It's not possible for all investors to invest a huge amount of money via lumpsum in mutual funds. So, SIP makes it easy for investors to invest in mutual funds by investing as little as ₹100.

- No need to time the market: With SIP investment investors need not worry about timing their entries. It’s often seen that investors delay the investment in order to wait for the correction to take place, but it's difficult to predict the market. But with SIP investors do not need to worry about the market ups and downs. Your SIP will be continuously investing in the market.

- Helps with Rupee Cost Average: The biggest benefit you will have from SIP is that it helps with the rupee cost average. You will buy more units when the market is down and you will earn fewer units when the market is up so, Rupee Cost Average means it lowers the overall cost by purchasing units at various rates.

- Power of Compounding: Investing in SIP helps you to earn from the power of compounding. Compounding ensures that you earn returns not only from the principal amount but also earn from the gain on that investment amount. Not only your investment earns returns but your returns also earn returns with the help of compounding.

- Power of investing early: SIP’s make it easier for anyone to start investing early even with a small corpus. Earlier investing through SIP’s can help one achieve his goals.

- Convenience: Investing in Mutual Fund through SIP gives you the convenience to invest in a market as low as ₹100.

- Additional Lumpsum Investment: You can do additional lumpsum investment anytime in the scheme in which you have your ongoing SIP.

Flexible Investment: In SIP investor has the flexibility to invest in a mutual fund on a monthly, quarterly, or yearly basis. You can start or stop your investments through SIP’s at any point in time.

Who should Invest in SIP?

People with higher income groups are more likely to invest in mutual funds because they have the ability to take on more risk, whereas people with lower income groups are more likely to invest in fixed deposits, bonds, and the post office, while businessmen are more likely to invest in the stock market.

However, the introduction of SIP in mutual funds has made it possible for small investors to invest in mutual funds as well. Investors can contribute as little as ₹100 in a SIP, and there is no limit to the maximum SIP, as it is a viable alternative for investors of all income groups.

According to the research, investing in mutual funds through a systematic investment plan (SIP) is less risky than investing through lumpsum mode. As a result, younger investors are more attracted to SIPs than older investors.

In a similar team, you can also start investing in mutual funds through SIP.

Let's take an example to understand SIP:

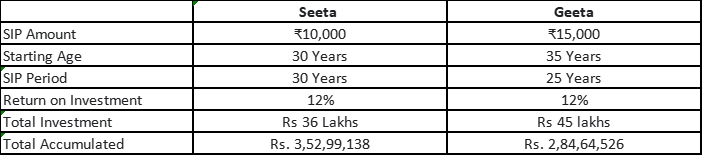

There are 2 friends Seeta and Geeta and both want to retire at 60 years. Seeta started her ₹10,000 SIP at the age of 30. Whereas Geeta was a little behind and started investing ₹15,000 at the age of 35. To compensate for the lost time, she is investing ₹5,000 more than Seeta.

This is how their investment turns out to be when they retire:

What we learn from this table:

- At the time of retirement, Seeta has 68 lakhs more than Geeta.

- Even the investment made by Geeta is 9 lakhs more than Seeta.

- Geeta began investing only 5 years after Seeta, despite the fact that she had to bear the repercussions by investing 9 lakhs more than Seeta, and in the end, Geeta still makes less compared to Seeta.

- We learned from this example that investing at a young age can benefit investors at the time of redemption.

This clearly demonstrates that time and compounding power do not wait for anyone. This is why, in order to meet your financial goals, you should begin your SIP as soon as feasible. Like a single drop of water that eventually becomes an ocean, your monthly SIP has the ability to help you accomplish your retirement goals.

Visit our Knowledge Center for more articles on Mutual Funds. You can also find many valuable blogs in our Help and Support section regarding Samco Mutual Fund.