Samco Active Momentum Fund - Direct Growth

Samco Active Momentum Fund - Direct Growth

Fund Overview

Fund Overview

The investment objective of the Scheme is to seek to generate long-term capital appreciation by investing in stocks showing strong momentum. Momentum stocks are such that exhibit positive price momentum – based on the phenomenon that stocks which have performed well in the past relative to other stocks (winners) continue to perform well in the future, and stocks that have performed relatively poorly (losers) continue to perform poorly.

However, there can be no assurance or guarantee that the investment objective of the scheme would be achieved.

| Key Highlights |

|---|

| The scheme will rebalance in real time as soon as the system detects a gain or loss of momentum in a particular stock. |

| The scheme will hedge to protect the downside when there is no or low momentum in the markets. |

| The proprietary momentum-seeking algorithm scans a universe of 750 stocks, including MicroCaps to find stocks that are gaining momentum. |

|

Type of scheme

|

An open-ended equity scheme following momentum theme

|

|

Plans

|

|

|

Benchmark Index

|

Nifty 500 TRI

|

|

STP Frequency

|

|

|

Minimum Application Amount of scheme

|

₹ 5000 and in multiples of ₹ 1/- thereafter

|

|

Minimum Additional Application Amount

|

₹ 500 and in multiples of ₹ 1/- thereafter

|

|

Minimum SIP Amount

|

₹ 500 and in multiples of ₹ 1/- thereafter

|

|

Entry Load

|

Not applicable

|

|

Exit Load

|

(With effect from October 03, 2024) |

Fund Manager

|

Mr. Umeshkumar MehtaDirector, CIO & Fund Manager

Ms. Nirali BhansaliCo-Fund Manager

Mr. Dhawal DhananiDedicated Fund Manager for overseas investments |

Portfolio

Portfolio| Issuers | Industry | % Of Net Assets | % to Derivatives |

|---|---|---|---|

| Wockhardt Ltd | Pharmaceuticals & Biotechnology | 7.64 | |

| One 97 Communications Ltd | Financial Technology (Fintech) | 7.51 | |

| Dixon Technologies (India) Ltd | Consumer Durables | 5.46 | 1.87 |

| Religare Enterprises Ltd | Finance | 4.77 | |

| Chambal Fertilizers & Chemicals Ltd | Fertilizers & Agrochemicals | 1.45 | 3.20 |

| UPL Ltd | Fertilizers & Agrochemicals | 3.88 | 0.30 |

| Swan Energy Ltd | Chemicals & Petrochemicals | 3.93 | |

| SBI Cards and Payment Services Ltd | Finance | 3.70 | |

| HDFC Bank Ltd | Banks | 3.59 | |

| Vedanta Ltd | Diversified Metals | 3.42 | |

| InterGlobe Aviation Ltd | Transport Services | 3.36 | |

| Muthoot Finance Ltd | Finance | 3.27 | |

| Bharti Airtel Ltd | Telecom - Services | 3.25 | |

| The Indian Hotels Company Ltd | Leisure Services | 1.95 | 1.20 |

| Laurus Labs Ltd | Pharmaceuticals & Biotechnology | 0.62 | 2.36 |

| Bajaj Finance Ltd | Finance | 2.91 | |

| Eicher Motors Ltd | Automobiles | 2.71 | |

| Divi's Laboratories Ltd | Pharmaceuticals & Biotechnology | 2.52 | |

| Max Healthcare Institute Ltd | Healthcare Services | 2.51 | |

| SRF Ltd | Chemicals & Petrochemicals | 2.45 | |

| BSE Ltd | Capital Markets | 2.35 | |

| Gabriel India Ltd | Auto Components | 2.18 | |

| Marathon Nextgen Realty Ltd | Realty | 1.77 | |

| Mahindra & Mahindra Ltd | Automobiles | 1.30 | |

| India Shelter Finance Corporation Ltd | Finance | 1.29 | |

| Kaveri Seed Company Ltd | Agricultural Food & other Products | 1.28 | |

| Avanti Feeds Ltd | Food Products | 1.27 | |

| Aavas Financiers Ltd | Finance | 1.25 | |

| Jupiter Life Line Hospitals Ltd | Healthcare Services | 1.21 | |

| Blue Jet Healthcare Ltd | Pharmaceuticals & Biotechnology | 0.94 | |

| Redington Ltd | Commercial Services & Supplies | 0.94 | |

| Marico Ltd | Agricultural Food & other Products | 0.83 | |

| United Breweries Ltd | Beverages | 0.81 | |

| Wipro Ltd | IT - Software | 0.70 | |

| Aarti Pharmalabs Ltd | Pharmaceuticals & Biotechnology | 0.61 | |

| Suven Pharmaceuticals Ltd | Pharmaceuticals & Biotechnology | 0.39 | |

| Radico Khaitan Ltd | Beverages | 0.32 | |

| AstraZeneca Pharma India Ltd | Pharmaceuticals & Biotechnology | 0.27 | |

| TREPS, Cash, Cash Equivalents and Net Current Asset | Cash & Cash Equivalents | 0.46 | |

| Grand Total | 100 |

Frequently asked questions

Frequently asked questions

It is a thematic fund that invests in stocks that exhibit momentum characteristics and sell those stocks when those stocks lose momentum.

Momentum works dues to behaviour biases of the investors in the financial markets. Investors are not always rational, they have limits to their control over emotions and are influenced by their own biases such as loss aversion, regret, anchoring and disposition biases. Because of all these human biases, there exists an opportunity in the momentum space which is more consistent and time tested strategy to make an alpha in the stock market.

It is a strategy to invest in winning stocks which are showing strong momentum. Momentum stocks are such that exhibit positive price momentum – based on the phenomenon that stocks which have performed well in the past relative to other stocks (winners) continue to perform well in the future, and stocks that have performed relatively poorly (losers) continue to perform poorly. The momentum strategy is based on buy high, sell higher or alternatively, cut your losses and let your winners run.

The scheme shall invest in stocks that exhibit momentum characteristics across market capitalisations i.e. Large Caps, Mid-Caps, Small Caps and Micro Cap companies. The fund intends to benefit from momentum in stock prices from short to medium term time frame. The fund makes trades based on trading signals generated by our intelligent algorithm. This algorithm has been developed by studying years of market data including price, volume, volatility, open interest, breakouts, relative strengths and correlations with appropriate weights on various data points. The Momentum investing is based on that gap in time that exists before mean reversion occurs. Momentum is usually seen in the short- to intermediate-term.

The universe for this fund will be Nifty 750 i.e. Nifty500 stocks and Nifty Micro cap 250 stocks.

There is no restriction on number of stocks in the fund. The scheme will hold stocks that are in momentum as deemed fit by the fund manager.

No, this scheme comes under the Distinctive Patterns Strategies which will have its own framework. This scheme does not heavily rely on quality of financials and has more emphasis on price, volume, breakouts and other technical indicators.

Nifty500 TRI will be the benchmark of the scheme.

Samco Active Momentum Fund - Direct Growth

Samco Active Momentum Fund - Direct Growth

(An open-ended equity scheme following momentum theme)

This product is suitable for investors who are seeking* :

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

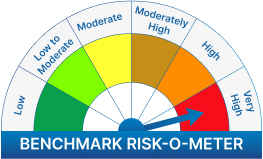

The risk of the scheme is moderate

We will notify you once Samco Active Momentum Fund - Direct Growth opens for subscriptions.

Enter the OTP received on mobile number +91 ![]() Edit

Edit

Mutual fund investments are subject to market risks, read all scheme related documents carefully.