Samco Dynamic Asset Allocation Fund - Direct Growth

Samco Dynamic Asset Allocation Fund - Direct Growth

Fund Overview

Fund Overview

The investment objective of the Scheme is to generate income/long-term capital appreciation by investing in equity, equity derivatives, fixed income instruments and foreign securities. The allocation between equity instruments and fixed income will be managed dynamically so as to provide investors with long term capital appreciation while managing downside risk.

However, there can be no assurance or guarantee that the investment objective of the scheme would be achieved

| Key Highlights |

|---|

| Momentum Trend following system - Only stay in the equities when the markets are trending upside |

| Drawdown Protection - Aim to limit drawdown during bear markets. |

| Dynamic in nature - A hybrid fund that can transform in to 100% Net Equity & 0% Debt or 100% Debt & 0% Net Equity. The fund doesn’t follow a static asset allocation. |

| Real time allocation model - Allows quick re-allocation to Debt from Equity Model and doesn’t wait for rebalancing cycles at monthly / quarterly frequencies. |

| Stop loss model - Quickly cuts equity exposure, risks and protects downside in tough times |

|

Type of scheme

|

An open ended dynamic asset allocation fund

|

|

Plans

|

|

|

Options

|

Growth option & Income Distribution cum Capital Withdrawal (IDCW) Option - IDCW - Reinvestment, IDCW – Payout, IDCW - Transfer

|

|

Benchmark Index

|

NIFTY 50 Hybrid Composite Debt 50:50 Index

|

|

STP Frequency

|

|

|

Minimum Application Amount of scheme

|

₹ 5000 and in multiples of ₹ 1/- thereafter

|

|

Minimum Additional Application Amount

|

₹ 500 and in multiples of ₹ 1/- thereafter

|

|

Minimum SIP Amount

|

₹ 500 and in multiples of ₹ 1/- thereafter

|

|

Entry Load

|

Not applicable

|

|

Exit Load

|

|

Fund Manager

|

Mr. Umeshkumar MehtaDirector, CIO & Fund Manager

Ms. Nirali BhansaliCo-Fund Manager

Mr. Dhawal DhananiDedicated Fund Manager for overseas investments |

Portfolio

Portfolio| Issuers | Industry | % Of Net Assets | % to Derivatives |

|---|---|---|---|

| Religare Enterprises Ltd | Finance | 9.99 | |

| Swan Energy Ltd | Chemicals & Petrochemicals | 3.45 | |

| Marathon Nextgen Realty Ltd | Realty | 2.55 | |

| Bajaj Finance Ltd | Finance | 1.92 | |

| Vedanta Ltd | Diversified Metals | 1.87 | -0.04 |

| Bharti Airtel Ltd | Telecom - Services | 3.08 | -1.32 |

| InterGlobe Aviation Ltd | Transport Services | 3.66 | -1.92 |

| Mahindra & Mahindra Ltd | Automobiles | 2.15 | -0.63 |

| Divi's Laboratories Ltd | Pharmaceuticals & Biotechnology | 2.23 | -0.74 |

| Bajaj Holdings & Investment Ltd | Finance | 1.34 | |

| Shree Cement Ltd | Cement & Cement Products | 1.33 | |

| Kotak Mahindra Bank Ltd | Banks | 1.32 | |

| Eicher Motors Ltd | Automobiles | 1.24 | |

| JSW Steel Ltd | Ferrous Metals | 1.21 | |

| HDFC Bank Ltd | Banks | 1.13 | |

| Bharat Electronics Ltd | Aerospace & Defense | 2.99 | -1.87 |

| ICICI Bank Ltd | Banks | 1.05 | |

| Bajaj Finserv Ltd | Finance | 1.04 | |

| Cholamandalam Investment and Finance Company Ltd | Finance | 1.00 | |

| Coromandel International Ltd | Fertilizers & Agrochemicals | 0.94 | |

| Shriram Finance Ltd | Finance | 1.58 | -0.66 |

| BSE Ltd | Capital Markets | 0.88 | |

| Info Edge (India) Ltd | Retailing | 1.63 | -0.85 |

| United Spirits Ltd | Beverages | 1.64 | -0.88 |

| Torrent Pharmaceuticals Ltd | Pharmaceuticals & Biotechnology | 1.70 | -0.96 |

| Fortis Healthcare Ltd | Healthcare Services | 0.72 | |

| Wipro Ltd | IT - Software | 0.69 | |

| Sun Pharmaceutical Industries Ltd | Pharmaceuticals & Biotechnology | 2.12 | -1.44 |

| Dixon Technologies (India) Ltd | Consumer Durables | 1.42 | -0.77 |

| Tech Mahindra Ltd | IT - Software | 0.61 | |

| Mazagon Dock Shipbuilders Ltd | Industrial Manufacturing | 0.54 | |

| Godrej Industries Ltd | Diversified | 0.51 | |

| Lloyds Metals And Energy Ltd | Minerals & Mining | 0.49 | |

| TVS Motor Company Ltd | Automobiles | 2.49 | -2.03 |

| Hitachi Energy India Ltd | Electrical Equipment | 0.45 | |

| Muthoot Finance Ltd | Finance | 0.44 | |

| Max Healthcare Institute Ltd | Healthcare Services | 0.40 | |

| One 97 Communications Ltd | Financial Technology (Fintech) | 0.40 | |

| Persistent Systems Ltd | IT - Software | 1.10 | -0.70 |

| UNO Minda Ltd | Auto Components | 0.39 | |

| SBI Cards and Payment Services Ltd | Finance | 0.38 | |

| Solar Industries India Ltd | Chemicals & Petrochemicals | 0.38 | |

| The Indian Hotels Company Ltd | Leisure Services | 0.38 | |

| SRF Ltd | Chemicals & Petrochemicals | 0.37 | |

| UPL Ltd | Fertilizers & Agrochemicals | 0.37 | |

| Lupin Ltd | Pharmaceuticals & Biotechnology | 0.95 | -0.61 |

| Cochin Shipyard Ltd | Industrial Manufacturing | 0.15 | |

| 7.38% Government of India (MD 20/06/2027) | Sovereign | 7.04 | |

| TREPS, Cash, Cash Equivalents and Net Current Asset | Cash & Cash Equivalents | 39.71 | |

| Grand Total | 100 |

Samco Dynamic Asset Allocation Fund - Direct Growth

Samco Dynamic Asset Allocation Fund - Direct Growth

(An open ended dynamic asset allocation fund)

This product is suitable for investors who are seeking* :

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

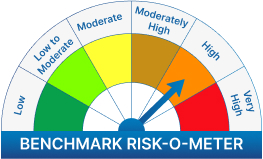

The risk of the scheme is moderate

We will notify you once Samco Dynamic Asset Allocation Fund - Direct Growth opens for subscriptions.

Enter the OTP received on mobile number +91 ![]() Edit

Edit

Mutual fund investments are subject to market risks, read all scheme related documents carefully.