We are live on "samco.mf@validicici" UPI ID, you can make your transfer choosing the UPI from the payment options.

We are live on "samco.mf@validicici" UPI ID, you can make your transfer choosing the UPI from the payment options.

We are live on "samco.mf@validicici" UPI ID, you can make your transfer choosing the UPI from the payment options.

We are live on "samco.mf@validicici" UPI ID, you can make your transfer choosing the UPI from the payment options.

Samco Dynamic Asset Allocation Fund - Direct IDCW

Samco Dynamic Asset Allocation Fund - Direct IDCW

Fund Overview

Fund Overview

The investment objective of the Scheme is to generate income/long-term capital appreciation by investing in equity, equity derivatives, fixed income instruments and foreign securities. The allocation between equity instruments and fixed income will be managed dynamically so as to provide investors with long term capital appreciation while managing downside risk.

However, there can be no assurance or guarantee that the investment objective of the scheme would be achieved

| Key Highlights |

|---|

| Momentum Trend following system - Only stay in the equities when the markets are trending upside |

| Drawdown Protection - Aim to limit drawdown during bear markets. |

| Dynamic in nature - A hybrid fund that can transform in to 100% Net Equity & 0% Debt or 100% Debt & 0% Net Equity. The fund doesn’t follow a static asset allocation. |

| Real time allocation model - Allows quick re-allocation to Debt from Equity Model and doesn’t wait for rebalancing cycles at monthly / quarterly frequencies. |

| Stop loss model - Quickly cuts equity exposure, risks and protects downside in tough times |

|

Type of scheme

|

An open ended dynamic asset allocation fund

|

|

Plans

|

|

|

Options

|

Growth option & Income Distribution cum Capital Withdrawal (IDCW) Option - IDCW - Reinvestment, IDCW – Payout, IDCW - Transfer

|

|

Benchmark Index

|

NIFTY 50 Hybrid Composite Debt 50:50 Index

|

|

STP Frequency

|

|

|

Minimum Application Amount of scheme

|

₹ 5000 and in multiples of ₹ 1/- thereafter

|

|

Minimum Additional Application Amount

|

₹ 500 and in multiples of ₹ 1/- thereafter

|

|

Minimum SIP Amount

|

₹ 250 and in multiples of ₹ 1/- thereafter

|

|

Entry Load

|

Not applicable

|

|

Exit Load

|

|

|

Fund Manager

|

Mr. Umeshkumar MehtaDirector, CIO & Fund Manager

Ms. Nirali BhansaliFund Manager

Mr. Dhawal DhananiFund Manager

Ms. Komal GroverFund Manager |

Portfolio

Portfolio| Issuers | Industry | % Of Net Assets | % to Derivatives |

|---|---|---|---|

| Indian Equity and Equity Related Total | 66.40 | 17.35 | |

| Religare Enterprises Limited | Finance | 8.43 | |

| Bharat Electronics Limited | Aerospace & Defense | 3.16 | |

| Maruti Suzuki India Limited | Automobiles | 1.46 | 1.66 |

| Eicher Motors Limited | Automobiles | 2.57 | 0.51 |

| TVS Motor Company Limited | Automobiles | 1.71 | 0.91 |

| Canara Bank | Banks | 0.52 | 2.02 |

| Bajaj Finance Limited | Finance | 2.36 | 0.03 |

| Bosch Limited | Auto Components | 0.45 | 1.91 |

| Eternal Limited | Retailing | 0.54 | 1.76 |

| Mahindra & Mahindra Limited | Automobiles | 2.00 | |

| HDFC Bank Limited | Banks | 1.97 | |

| State Bank of India | Banks | 0.40 | 1.54 |

| Adani Power Limited | Power | 1.87 | |

| JSW Steel Limited | Ferrous Metals | 1.65 | 0.21 |

| Bharti Airtel Limited | Telecom - Services | 1.85 | |

| Solar Industries India Limited | Chemicals & Petrochemicals | 0.66 | 1.17 |

| SBI Life Insurance Company Limited | Insurance | 1.53 | 0.26 |

| Punjab National Bank | Banks | 0.35 | 1.42 |

| InterGlobe Aviation Limited | Transport Services | 1.56 | 0.11 |

| Jindal Steel Limited | Ferrous Metals | 0.31 | 1.29 |

| L&T Finance Limited | Finance | 0.75 | 0.62 |

| GE Vernova T&D India Limited | Electrical Equipment | 1.34 | |

| Torrent Pharmaceuticals Limited | Pharmaceuticals & Biotechnology | 1.07 | 0.26 |

| Shree Cement Limited | Cement & Cement Products | 0.96 | 0.32 |

| Bajaj Holdings & Investment Limited | Finance | 1.26 | |

| Fortis Healthcare Limited | Healthcare Services | 1.36 | -0.13 |

| HDFC Life Insurance Company Limited | Insurance | 1.16 | 0.03 |

| Muthoot Finance Limited | Finance | 0.66 | 0.51 |

| Indian Bank | Banks | 0.25 | 0.88 |

| Britannia Industries Limited | Food Products | 0.97 | 0.09 |

| One 97 Communications Limited | Financial Technology (Fintech) | 1.15 | -0.12 |

| Aditya Birla Capital Limited | Finance | 1.24 | -0.23 |

| Tata Consumer Products Limited | Agricultural Food & other Products | 0.87 | 0.02 |

| Endurance Technologies Limited | Auto Components | 0.85 | |

| FSN E-Commerce Ventures Limited | Retailing | 0.18 | 0.67 |

| JK Cement Limited | Cement & Cement Products | 0.83 | |

| MRF Limited | Auto Components | 0.81 | |

| Max Financial Services Limited | Insurance | 1.59 | -0.83 |

| Hero MotoCorp Limited | Automobiles | 0.17 | 0.59 |

| Nippon Life India Asset Management Limited | Capital Markets | 0.76 | |

| AU Small Finance Bank Limited | Banks | 1.17 | -0.45 |

| UNO Minda Limited | Auto Components | 0.56 | 0.15 |

| Ashok Leyland Limited | Agricultural, Commercial & Construction Vehicles | 0.19 | 0.48 |

| BSE Limited | Capital Markets | 1.94 | -1.29 |

| HDFC Asset Management Company Limited | Capital Markets | 0.19 | 0.46 |

| Glenmark Pharmaceuticals Limited | Pharmaceuticals & Biotechnology | 0.38 | 0.25 |

| Polycab India Limited | Industrial Products | 0.16 | 0.46 |

| Motilal Oswal Financial Services Limited | Capital Markets | 0.59 | |

| Cochin Shipyard Limited | Industrial Manufacturing | 0.54 | |

| Bharti Hexacom Limited | Telecom - Services | 0.51 | |

| Bharat Dynamics Limited | Aerospace & Defense | 1.00 | -0.50 |

| Hitachi Energy India Limited | Electrical Equipment | 0.50 | |

| Godfrey Phillips India Limited | Cigarettes & Tobacco Products | 0.48 | |

| Dalmia Bharat Limited | Cement & Cement Products | 0.16 | 0.31 |

| Coromandel International Limited | Fertilizers & Agrochemicals | 0.45 | |

| Choice International Limited | Finance | 0.29 | |

| Laurus Labs Limited | Pharmaceuticals & Biotechnology | 0.27 | |

| Force Motors Limited | Automobiles | 0.26 | |

| Gujarat Mineral Development Corporation Limited | Minerals & Mining | 0.26 | |

| Netweb Technologies India Limited | IT - Services | 0.26 | |

| Anand Rathi Wealth Limited | Capital Markets | 0.23 | |

| RBL Bank Limited | Banks | 0.22 | |

| Syrma SGS Technology Limited | Industrial Manufacturing | 0.22 | |

| Aster DM Healthcare Limited | Healthcare Services | 0.21 | |

| Delhivery Limited | Transport Services | 0.21 | |

| HBL Engineering Limited | Industrial Products | 0.21 | |

| Multi Commodity Exchange of India Limited | Capital Markets | 0.21 | |

| eClerx Services Limited | Commercial Services & Supplies | 0.19 | |

| City Union Bank Limited | Banks | 0.17 | |

| JM Financial Limited | Finance | 0.17 | |

| Maharashtra Scooters Limited | Finance | 0.17 | |

| Garden Reach Shipbuilders & Engineers Limited | Aerospace & Defense | 0.15 | |

| Manappuram Finance Limited | Finance | 0.15 | |

| Deepak Fertilizers and Petrochemicals Corporation Limited | Chemicals & Petrochemicals | 0.13 | |

| 6 TVS Motor Co Non Conv Rede Pref Shares 01SEP26 | Automobiles | 0.02 | |

| Debt Instruments | 8.19 | ||

| 7.38 Government of India (MD 20/06/2027) | Sovereign | 8.19 | |

| TREPS, Cash, Cash Equivalents and Net Current Asset | Cash & Cash Equivalents | 8.06 | |

| Grand Total | 100 |

Fund Performance (as on 2025-10-31)

Fund Performance (as on 2025-10-31)| Period | Fund Returns (%) | Benchmark Returns (%) | Additional Benchmark Returns (%) | Value of Investment of 10,000 | ||

|---|---|---|---|---|---|---|

| Fund (₹) | Benchmark (₹) | Additional Benchmark (₹) | ||||

| Regular Plan - Growth Option | ||||||

| Last 1 year | -1.87% | 7.29% | 7.59% | 9,813 | 10,729 | 10,759 |

| Since Inception | 2.79% | 9.51% | 10.85% | 10,520 | 11,824 | 12,093 |

| Direct Plan - Growth Option | ||||||

| Last 1 year | -0.37% | 7.29% | 7.59% | 9,963 | 10,729 | 10,759 |

| Since Inception | 4.47% | 9.51% | 10.85% | 10,840 | 11,824 | 12,093 |

Benchmark: Nifty 50 Hybrid Composite Debt 50:50 Index Additional Benchmark: Nifty 50 TRI Inception/Allotment date: 28-Dec-23

Past performance may or may not be sustained in the future. Returns computed on compounded annualised basis based on the NAV. Different Plans i.e. Regular Plan and Direct Plan under the scheme has different expense structure. The “since inception” returns of the scheme are calculated on Rs. 10/- invested at inception. The Fund is co-managed by Mr. Umeshkumar Mehta (since inception), Mrs. Nirali Bhansali (since February 19, 2025), Mr. Dhawal Ghanshyam Dhanani (since inception) and Ms. Komal Grover (since July 17, 2025). In case, the start / end date of the concerned period is a non-business date (NBD), the NAV of the previous date is considered for computation of returns.

Samco Dynamic Asset Allocation Fund - Direct IDCW

Samco Dynamic Asset Allocation Fund - Direct IDCW

(An open ended dynamic asset allocation fund)

This product is suitable for investors who are seeking* :

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

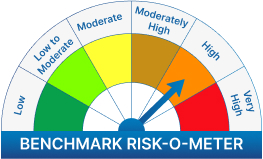

The risk of the scheme is moderate

We will notify you once Samco Dynamic Asset Allocation Fund - Direct IDCW - Payout opens for subscriptions.

Enter the OTP received on mobile number +91 ![]() Edit

Edit

Mutual fund investments are subject to market risks, read all scheme related documents carefully.