Samco ELSS Tax Saver Fund - Regular Growth

Samco ELSS Tax Saver Fund - Regular Growth

Fund Overview

Fund OverviewThe investment objective of the scheme is to generate long-term capital appreciation through investments made predominantly in equity and equity related instruments. However, there can be no assurance or guarantee that the investment objective of the scheme would be achieved.

| Key Highlights |

|---|

| Differentiated product offering with higher potential to generate alpha due to a predominantly MidCap and SmallCap portfolio |

| Higher risks and volatility which can efficiently be managed due to a 3-year lock-in |

| Qualifies for Tax Deduction under Section 80C of Income Tax Act, 1961 |

| Long Term Capital Gains of up to ₹ 1 lakh are tax-exempt |

|

Asset Allocation Pattern

|

The asset allocation under the scheme will be follows:

Equity related instruments shall mean equities, cumulative convertible preference shares and fully convertible debentures and bonds of companies. Investment may also be made in partly convertible issues of debentures and bonds including those issued on rights basis subject to the condition that, as far as possible, the non-convertible portion of the debentures so acquired or subscribed, shall be disinvested within a period of 12 (twelve) months. All investments by the Scheme inequity shares and equity related instruments shall only be made provided such securities are listed or to be listed. |

||||||||||||||||

|

Type of scheme

|

An Open-ended Equity Linked Saving Scheme with a statutory lock-in of 3 years and tax benefit

|

||||||||||||||||

|

Plans

|

|

||||||||||||||||

|

Benchmark Index

|

Nifty 500 TRI

|

||||||||||||||||

|

STP Frequency

|

|

||||||||||||||||

|

Minimum Application Amount of scheme

|

₹ 500 and in multiples of ₹ 500/- thereafter

|

||||||||||||||||

|

Minimum Additional Application Amount

|

₹ 500 and in multiples of ₹ 500/- thereafter

|

||||||||||||||||

|

Minimum SIP Amount

|

₹ 500 and in multiples of ₹ 500/- thereafter

|

||||||||||||||||

|

Entry Load

|

Not applicable

|

||||||||||||||||

|

Exit Load

|

|

Fund Manager

|

Mr. Umeshkumar MehtaDirector, CIO & Fund Manager

Ms. Nirali BhansaliCo-Fund Manager

Mr. Dhawal DhananiDedicated Fund Manager for overseas investments |

||||||||||||||

Portfolio

Portfolio| Issuers | Industry | % Of Net Assets |

|---|---|---|

| Motilal Oswal Financial Services Ltd | Capital Markets | 6.03 |

| Persistent Systems Ltd | IT - Software | 4.19 |

| Nippon Life India Asset Management Ltd | Capital Markets | 3.74 |

| Avanti Feeds Ltd | Food Products | 3.71 |

| Muthoot Finance Ltd | Finance | 3.55 |

| Solar Industries India Ltd | Chemicals & Petrochemicals | 3.28 |

| Coromandel International Ltd | Fertilizers & Agrochemicals | 3.27 |

| Mazagon Dock Shipbuilders Ltd | Industrial Manufacturing | 3.25 |

| AstraZeneca Pharma India Ltd | Pharmaceuticals & Biotechnology | 3.24 |

| Caplin Point Laboratories Ltd | Pharmaceuticals & Biotechnology | 3.18 |

| Sumitomo Chemical India Ltd | Fertilizers & Agrochemicals | 3.06 |

| 360 One WAM Ltd | Capital Markets | 3.04 |

| Affle (India) Ltd | IT - Services | 3.04 |

| ICICI Bank Ltd | Banks | 2.92 |

| GlaxoSmithKline Pharmaceuticals Ltd | Pharmaceuticals & Biotechnology | 2.91 |

| Marico Ltd | Agricultural Food & other Products | 2.90 |

| Abbott India Ltd | Pharmaceuticals & Biotechnology | 2.87 |

| Gillette India Ltd | Personal Products | 2.84 |

| K.P.R. Mill Ltd | Textiles & Apparels | 2.83 |

| eClerx Services Ltd | Commercial Services & Supplies | 2.79 |

| Zensar Technologies Ltd | IT - Software | 2.74 |

| Hindustan Zinc Ltd | Non - Ferrous Metals | 2.73 |

| Manappuram Finance Ltd | Finance | 2.61 |

| Page Industries Ltd | Textiles & Apparels | 2.51 |

| Ajanta Pharma Ltd | Pharmaceuticals & Biotechnology | 2.48 |

| Coforge Ltd | IT - Software | 2.36 |

| BLS International Services Ltd | Leisure Services | 2.28 |

| Petronet LNG Ltd | Gas | 2.26 |

| UTI Asset Management Company Ltd | Capital Markets | 2.11 |

| Computer Age Management Services Ltd | Capital Markets | 1.98 |

| Dixon Technologies (India) Ltd | Consumer Durables | 1.96 |

| Central Depository Services (India) Ltd | Capital Markets | 1.92 |

| Swan Energy Ltd | Chemicals & Petrochemicals | 1.81 |

| Newgen Software Technologies Ltd | IT - Software | 1.64 |

| Bharat Dynamics Ltd | Aerospace & Defense | 1.32 |

| TREPS, Cash, Cash Equivalents and Net Current Asset | Cash & Cash Equivalents | 0.65 |

| Grand Total | 100 |

Frequently asked questions

Frequently asked questions

Equity Linked Saving Scheme (ELSS), also known as tax-saver fund, is an open ended Equity mutual fund scheme that invest primary in equity related products. However, these ELSS mutual funds have a three-year mandatory lock in term, which is the shortest lock in period if compared to all other products that are available under Section 80C of the Income Tax Act, 1961.

Investors who wish to invest for a minimum of 3 years and are looking for higher return potential, plus the added benefit to save tax under section 80C can invest in ELSS Tax Saver Fund. At the same time, the investors should also prepare for a certain amount of risk attached to it. This is because of the equity exposure in the portfolio. Therefore, ELSS mutual funds are best suited for investors who understand equity asset class risk. These tax saver funds offer higher returns potential when compared to other tax saving schemes.

The following are the critical factors that must be considered by investors before they invest in ELSS Tax saver fund:

Yes, ELSS has a lock-in period of three years. This means one cannot withdraw their money before the said tenure ends. However, ELSS has the shortest lock-in period as compared to other similar tax-saving investments currently such as 5-year Fixed Deposits (five years), National Savings Certificate (five years), Public Provident Fund (15 years), etc.

The redemption proceeds of ELSS are not entirely tax-free. The long-term capital gains of up to Rs 1,00,000 a year are tax-free, and any gains above this limit attract a long-term capital gains tax at the rate of 10% plus applicable cess and surcharge.

The investment objective of the scheme is to generate long-term capital appreciation through investments made predominantly in equity and equity related instruments. However, there can be no assurance or guarantee that the investment objective of the scheme would be achieved.

The Fund's strategy will endeavor to have a predominantly higher allocation to mid and small cap companies which will be selected through focusing on the fundamentals of the business, the industry structure, the quality of management, sensitivity to economic factors, the financial strength of the company and the key earnings drivers. The scheme will invest in about 30-40 scripts to ensure adequate diversification and reduced risk.

The following persons (subject to, wherever relevant, purchase of Units of mutual funds, being permitted under respective constitutions, and relevant statutory regulations) are eligible and may apply for Subscription to the Units of the Scheme:

The above list of persons in category 4 to 18 are not eligible for tax benefits under Section 80 C of the Income-tax Act, 1961 but are entitled to subscribe to units.

The minimum amount for application for an investor will be Rs. 500.

There is Nil entry/exit load on Samco ELSS Tax Saver Fund.

The Scheme performance would be benchmarked against Nifty 500 TRI

Samco ELSS Tax Saver Fund - Regular Growth

Samco ELSS Tax Saver Fund - Regular Growth

(An Open-ended Equity Linked Saving Scheme with a statutory lock-in of 3 years and tax benefit)

This product is suitable for investors who are seeking* :

**Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

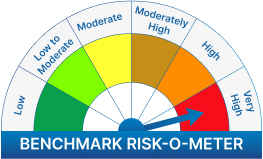

The risk of the scheme is very high

We will notify you once Samco ELSS Tax Saver Fund - Regular Growth opens for subscriptions.

Enter the OTP received on mobile number +91 ![]() Edit

Edit

Mutual fund investments are subject to market risks, read all scheme related documents carefully.