Samco Flexi Cap Fund - Direct Growth

Samco Flexi Cap Fund - Direct Growth

Fund Overview

Fund OverviewThe investment objective of the Scheme is to seek to generate long-term capital growth from an actively managed portfolio of Indian & foreign equity instruments across market capitalization. However, there is no assurance or guarantee that the investment objective of the Scheme will be achieved.

| Key Highlights |

|---|

| Investing in portfolio of 25 efficient HexaShield tested businesses |

| Investing in high growth Indian and global businesses |

| Fund portfolio with high active share (>80%) |

| Equity fund, no derivatives & no hedging |

| Well-defined exit framework |

| 65% Indian equities (min) 35% Global equities (max) |

|

Type of scheme

|

An open-ended dynamic equity scheme investing across large cap, mid cap, small cap stocks

|

|

Plans

|

|

|

Benchmark Index

|

Nifty 500 Index TRI

|

|

STP Frequency

|

|

|

Minimum Application Amount of scheme

|

₹ 5000 and in multiples of ₹ 1/- thereafter

|

|

Minimum Additional Application Amount

|

₹ 500 and in multiples of ₹ 1/- thereafter

|

|

Minimum SIP Amount

|

₹ 500 and in multiples of ₹ 1/- thereafter

|

|

Entry Load

|

Not applicable

|

|

Exit Load

|

10% of the units allotted may be redeemed without any exit load, on or before completion of 12 months from the date of allotment of units. Any redemption in excess of such limit in the first 12 months from the date of allotment shall be subject to the following exit load: (With effect from June 01, 2024) |

Fund Manager

|

Mr. Umeshkumar MehtaDirector, CIO & Fund Manager

Ms. Nirali BhansaliCo-Fund Manager

Mr. Dhawal DhananiDedicated Fund Manager for overseas investments |

Portfolio

Portfolio| Issuers | Industry | % Of Net Assets |

|---|---|---|

| Caplin Point Laboratories Ltd | Pharmaceuticals & Biotechnology | 6.65 |

| Bharat Electronics Ltd | Aerospace & Defense | 6.22 |

| Muthoot Finance Ltd | Finance | 4.70 |

| AstraZeneca Pharma India Ltd | Pharmaceuticals & Biotechnology | 4.54 |

| Mazagon Dock Shipbuilders Ltd | Industrial Manufacturing | 4.48 |

| Swan Energy Ltd | Chemicals & Petrochemicals | 4.42 |

| Central Depository Services (India) Ltd | Capital Markets | 4.02 |

| Page Industries Ltd | Textiles & Apparels | 3.86 |

| Ventive Hospitality Ltd | Leisure Services | 3.66 |

| eClerx Services Ltd | Commercial Services & Supplies | 3.60 |

| Persistent Systems Ltd | IT - Software | 3.57 |

| 360 One WAM Ltd | Capital Markets | 3.48 |

| Gillette India Ltd | Personal Products | 3.48 |

| Coromandel International Ltd | Fertilizers & Agrochemicals | 3.46 |

| Ajanta Pharma Ltd | Pharmaceuticals & Biotechnology | 3.43 |

| Zensar Technologies Ltd | IT - Software | 3.40 |

| Manappuram Finance Ltd | Finance | 3.35 |

| Bharat Dynamics Ltd | Aerospace & Defense | 3.32 |

| Coforge Ltd | IT - Software | 3.30 |

| Motilal Oswal Financial Services Ltd | Capital Markets | 3.30 |

| Avanti Feeds Ltd | Food Products | 3.22 |

| Dixon Technologies (India) Ltd | Consumer Durables | 3.14 |

| Abbott India Ltd | Pharmaceuticals & Biotechnology | 3.13 |

| Affle (India) Ltd | IT - Services | 3.06 |

| Newgen Software Technologies Ltd | IT - Software | 2.53 |

| K.P.R. Mill Ltd | Textiles & Apparels | 2.48 |

| Marico Ltd | Agricultural Food & other Products | 1.68 |

| Sumitomo Chemical India Ltd | Fertilizers & Agrochemicals | 0.59 |

| TREPS, Cash, Cash Equivalents and Net Current Asset | Cash & Cash Equivalents | -0.07 |

| Grand Total | 100 |

Frequently asked questions

Frequently asked questions

Samco Flexi Cap Fund is suitable for all investors who want to invest in equity markets for a minimum period of 3 years and are looking to own efficient businesses across the globe.

Samco Flexi Cap Fund's performance would be benchmarked against NIFTY500 TRI. Please understand that the performance of the benchmark is a broad measurement of the changes in the stock markets. It is to be used only for comparative purposes only and in no way indicates the potential performance of the Samco Flexi Cap Fund.

Resident adult individuals either singly or jointly (not exceeding three) or on an Anyone or Survivor basis; 2. Hindu Undivided Family (HUF) through Karta; 3. Minor (as the first and the sole holder only) through a natural guardian (i.e. father or mother, as the case may be) or a court appointed legal guardian. There shall not be any joint holding with minor investments; 4. Partnership Firms including limited liability partnership firms; 5. Proprietorship in the name of the sole proprietor; 6. Companies, Bodies Corporate, Public Sector Undertakings (PSUs), Association of Persons (AOP) or Bodies of Individuals (BOI) and societies registered under the Societies Registration Act, 1860(so long as the purchase of Units is permitted under the respective constitutions); 7. Banks (including Co-operative Banks and Regional Rural Banks) and Financial Institutions; 8. Religious and Charitable Trusts, Wakfs or endowments of private trusts (subject to receipt of necessary approvals as "Public Securities" as required) and Private trusts authorised to invest in mutual fund schemes under their trust deeds; 9. Non-Resident Indians (NRIs) / Persons of Indian origin (PIOs)/ Overseas Citizen of India (OCI) residing abroad on repatriation basis or on non repatriation basis; 10 Foreign Institutional Investors (FIIs) and their sub-accounts registered with SEBI on repatriation basis; 11. Army, Air Force, Navy and other paramilitary units and bodies created by such institutions; 12. Scientific and Industrial Research Organizations; 13. Multilateral Funding Agencies / Bodies Corporate incorporated outside India with the permission of Government of India / RBI; 14. Provident/ Pension/ Gratuity Fund to the extent they are permitted; 15. Other schemes of Samco Mutual Fund or any other mutual fund subject to the conditions and limits prescribed by the SEBI (MF) Regulations; 16. Schemes of Alternative Investment Funds; 17. Trustee, AMC or Sponsor or their associates may subscribe to Units under the Scheme; 18. Qualified Foreign Investor (QFI) 19. Such other person as maybe decided by the AMC from time to time. The list given above is indicative and the applicable laws, if any, as amended from time to time shall supersede the list.

We are only investing in the high-quality efficient businesses and we try to invest in them at an efficient price and hence it is assumed that we will not have to make too many changes in the portfolio

It will have 25 of the best businesses across the globe with at least 65% of businesses from India and 35% from across the globe.

It is simple 3-step strategy that we follow at the fund level -

Voluntary dealing cost is something that is deducted from the NAV and occurs due to excessive turnover or changes in the portfolio of the fund. Samco Flexi Cap aims at keeping this cost to a minimum by reducing the change in the portfolio

The Foreign Account Tax Compliance Act (FATCA) is a United States Federal Law, aimed at prevention of tax evasion by United States taxpayers through use of offshore accounts. The provisions of FATCA essentially provide for 30% withholding tax on US source payments made to Foreign Financial Institutions unless they enter into an agreement with the Internal Revenue Service (US IRS) to provide information about accounts held with them by USA persons or entities (firms/companies/trusts) controlled by USA persons.

Samco Flexi Cap Fund - Direct Growth

Samco Flexi Cap Fund - Direct Growth

(An open-ended dynamic equity scheme investing across large cap, mid cap, small cap stocks)

This product is suitable for investors who are seeking* :

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

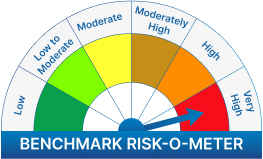

The risk of the scheme is very high

We will notify you once Samco Flexi Cap Fund - Direct Growth opens for subscriptions.

Enter the OTP received on mobile number +91 ![]() Edit

Edit

Mutual fund investments are subject to market risks, read all scheme related documents carefully.