Samco Large Cap Fund - Direct Growth

Samco Large Cap Fund - Direct Growth

Fund Overview

Fund Overview

The investment objective of the Scheme is to generate long-term capital appreciation from a diversified portfolio predominantly consisting of equity and equity related instruments of large cap companies.

There is no assurance that the investment objective of the scheme will be achieved.

| Key Highlights |

|---|

| Cross-sectional momentum is the core criterion for stock selection which identifies and invests in top-performing large-cap stocks with consistent price strength, outperforming their sector and indices. |

| Absolute momentum assesses the directional trend of stocks or the market, regardless of relative performance. If the trend turns negative, the fund employs tactical measures, including derivatives and hedging, to reduce net equity exposure and protect against drawdowns. |

| Revenue momentum focuses on companies with strong top-line growth, highlighting those with consistent sales increases that precede earnings growth. This approach ensures the portfolio includes growth stocks that can sustain market leadership and capture long-term value creation. |

| Earnings momentum identifies companies with rapid growth in profitability at the PBT (Profit Before Tax) and PAT (Profit After Tax) levels, reflecting their ability to translate operational efficiency and revenue growth into shareholder value. |

|

NFO Period

|

March 05, 2025 to March 19, 2025

|

|

Type of scheme

|

An open ended equity scheme predominantly investing in large cap stocks

|

|

Plans

|

|

|

Benchmark Index

|

NIFTY 100 Total Returns Index

|

|

STP Frequency

|

|

|

Minimum Application Amount of scheme

|

₹ 5000 and in multiples of ₹ 1/- thereafter

|

|

Minimum Additional Application Amount

|

₹ 500 and in multiples of ₹ 1/- thereafter

|

|

Minimum SIP Amount

|

₹ 500 and in multiples of ₹ 1/- thereafter

|

|

Entry Load

|

Not applicable

|

|

Exit Load

|

|

Fund Manager

|

Mr. Umeshkumar MehtaDirector, CIO & Fund Manager

Ms. Nirali BhansaliFund Manager

Mr. Dhawal DhananiFund Manager |

Frequently asked questions

Frequently asked questions

Large Cap companies are the 1st to 100th company in terms of market capitalization. Large Cap Funds are those equity-oriented mutual funds that invest at least 80% of their funds in large cap companies.

It is a strategy to invest in winning stocks which are showing strong momentum. Momentum stocks are such that exhibit positive price momentum – based on the phenomenon that stocks which have performed well in the past relative to other stocks (winners) continue to perform well in the future, and stocks that have performed relatively poorly (losers) continue to perform poorly. The momentum strategy is based on buy high, sell higher or alternatively, cut your losses and let your winners run.

Momentum works due to behaviour biases of the investors in the financial markets. Investors are not always rational, they have limits to their control over emotions and are influenced by their own biases such as loss aversion, regret, anchoring and disposition biases. Because of all these human biases, there exists an opportunity in the momentum space which is more consistent and time-tested strategy to make an alpha in the stock market.

SAMCO Large Cap Fund uses a cutting-edge momentum-based strategy with SAMCO's proprietary C.A.R.E. Momentum system to deliver superior risk-adjusted returns. It identifies large-cap stocks with strong momentum in Cross Sectional, Absolute, Revenue, and Earnings Momentum. By focusing on the top 100 companies by market capitalization, the fund optimizes the portfolio and mitigates risks using derivatives and hedging during market volatility.

Samco Large Cap Fund uses C.A.R.E Momentum Strategy which invests in large cap stocks that are showing momentum characteristics in Cross Sectional, Absolute, Revenue, and Earnings Momentum to deliver superior risk-adjusted returns. During periods of anti-momentum, net equity exposure could go to 0% using arbitrage and hedging while in periods of momentum Gross and Net Equity exposure could go up to 100%. The scheme may invest up to 100% of its net assets in equity & equity related instruments. The net equity exposure could go to 0% to protect the downside risk. This fund combines an active momentum strategy along with investing in large caps which will generate alpha for investors over the long term

The minimum investment amount for lumpsum is Rs.5,000 and in multiples of ₹1/- thereafter and for Systematic Investment Plan (SIP) it is Rs. 500 and in multiples of ₹1/- thereafter.

There is no entry load applicable. 10% of units can be redeemed without an exit load within 12 months of allotment. Any redemption in excess of such limit in the first 12 months will incur 1% exit load. No exit load, if redeemed or switched out after 12 months from the date of allotment of unit.

The fund will be jointly managed by Ms. Nirali Bhansali and Mr. Umeshkumar Mehta and Mr. Dhawal Ghanshyam Dhanani.

The benchmark for this scheme is NIFTY 100 Total Returns Index

(An open ended equity scheme predominantly investing in large cap stocks)

This product is suitable for investors who are seeking* :

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

(The product labelling assigned during the New Fund Offer is based on internal assessment of the scheme characteristics or model portfolio and

the same may vary post NFO when actual investments are made)

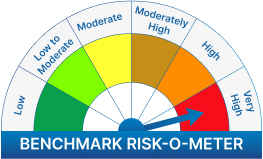

The risk of the scheme is very high

We will notify you once Samco Large Cap Fund - Direct Growth opens for subscriptions.

Enter the OTP received on mobile number +91 ![]() Edit

Edit

Mutual fund investments are subject to market risks, read all scheme related documents carefully.