Samco Multi Asset Allocation Fund - Regular Growth

Samco Multi Asset Allocation Fund - Regular Growth

Fund Overview

Fund Overview

The investment objective of the scheme is to generate long term capital appreciation by investing in a diversified portfolio of equity and equity related instruments, debt and money market instruments, Exchange Traded Commodity Derivatives / Units of Gold ETFs, Silver ETF & units of REITs/InvITs.

There is no assurance that the investment objective of the scheme will be achieved.

| Key Highlights |

|---|

| Gold : Ability to transform into a predominantly Gold Fund when Gold is trending upwards inversely vs Equity. |

| Real Time Allocation Model : Allows quick re-allocation between 3 modes and doesn’t wait for quarterly/monthly rebalancing cycles. |

| Dynamic in nature : A hybrid fund that can transform into pre-dominantly Equity Mode or Gold Mode or Debt Mode. |

| Drawdown Protection : Limited drawdown during bear markets. |

| Momentum Trend following system : Only stay in the equities when the markets are trending upside. |

|

Type of scheme

|

An open ended scheme investing in Equity, Fixed Income, Exchange Traded Commodity Derivatives / Units of Gold ETFs / Silver ETFs & units of REITs/InvITs

|

|

Plans

|

|

|

Benchmark Index

|

65% Nifty 50 TRI + 20% CRISIL Short Term Bond Fund Index + 10% Domestic Price of Gold + 5% Domestic Price of Silver

|

|

STP Frequency

|

|

|

Minimum Application Amount of scheme

|

₹ 5000 and in multiples of ₹ 1/- thereafter

|

|

Minimum Additional Application Amount

|

₹ 500 and in multiples of ₹ 1/- thereafter

|

|

Minimum SIP Amount

|

₹ 500 and in multiples of ₹ 1/- thereafter

|

|

Entry Load

|

Not applicable

|

|

Exit Load

|

|

Fund Manager

|

Mr. Umeshkumar MehtaDirector, CIO & Fund Manager

Ms. Nirali BhansaliCo-Fund Manager

Mr. Dhawal DhananiDedicated Fund Manager for overseas investments |

Portfolio

Portfolio| Issuers | Industry | % Of Net Assets | % to Derivatives |

|---|---|---|---|

| Dixon Technologies (India) Ltd | Consumer Durables | 1.53 | |

| Coforge Ltd | IT - Software | 1.43 | |

| Lloyds Metals And Energy Ltd | Minerals & Mining | 0.74 | |

| Coromandel International Ltd | Fertilizers & Agrochemicals | 0.64 | |

| Muthoot Finance Ltd | Finance | 1.54 | -0.92 |

| Mazagon Dock Shipbuilders Ltd | Industrial Manufacturing | 0.58 | |

| BSE Ltd | Capital Markets | 0.55 | |

| Divi's Laboratories Ltd | Pharmaceuticals & Biotechnology | 0.47 | |

| Fortis Healthcare Ltd | Healthcare Services | 0.47 | |

| Bajaj Finance Ltd | Finance | 0.46 | |

| One 97 Communications Ltd | Financial Technology (Fintech) | 0.45 | |

| The Indian Hotels Company Ltd | Leisure Services | 0.44 | |

| Max Healthcare Institute Ltd | Healthcare Services | 0.42 | |

| SRF Ltd | Chemicals & Petrochemicals | 0.42 | |

| Vedanta Ltd | Diversified Metals | 0.42 | |

| Bajaj Holdings & Investment Ltd | Finance | 0.41 | |

| Persistent Systems Ltd | IT - Software | 0.89 | -0.48 |

| Eicher Motors Ltd | Automobiles | 0.39 | |

| UPL Ltd | Fertilizers & Agrochemicals | 0.39 | |

| InterGlobe Aviation Ltd | Transport Services | 0.38 | |

| SBI Cards and Payment Services Ltd | Finance | 0.38 | |

| JSW Steel Ltd | Ferrous Metals | 0.37 | |

| Bharti Airtel Ltd | Telecom - Services | 0.36 | |

| Kotak Mahindra Bank Ltd | Banks | 0.36 | |

| Shree Cement Ltd | Cement & Cement Products | 0.36 | |

| HDFC Bank Ltd | Banks | 0.35 | |

| Bharat Electronics Ltd | Aerospace & Defense | 0.34 | |

| Godrej Industries Ltd | Diversified | 0.34 | |

| ICICI Bank Ltd | Banks | 0.34 | |

| Mahindra & Mahindra Ltd | Automobiles | 0.33 | |

| Hindalco Industries Ltd | Non - Ferrous Metals | 0.32 | |

| Cholamandalam Investment and Finance Company Ltd | Finance | 0.31 | |

| Bajaj Finserv Ltd | Finance | 0.30 | |

| Shriram Finance Ltd | Finance | 0.29 | |

| Info Edge (India) Ltd | Retailing | 0.24 | |

| Tata Steel Ltd | Ferrous Metals | 0.24 | |

| Torrent Pharmaceuticals Ltd | Pharmaceuticals & Biotechnology | 0.22 | |

| United Spirits Ltd | Beverages | 0.22 | |

| Sun Pharmaceutical Industries Ltd | Pharmaceuticals & Biotechnology | 0.21 | |

| Unimech Aerospace and Manufacturing Ltd | Aerospace & Defense | 0.05 | |

| HDFC Asset Management Company Ltd | Capital Markets | 0.42 | -0.39 |

| Computer Age Management Services Ltd | Capital Markets | 0.26 | -0.24 |

| Page Industries Ltd | Textiles & Apparels | 0.02 | |

| Petronet LNG Ltd | Gas | 0.47 | -0.46 |

| Central Depository Services (India) Ltd | Capital Markets | 0.01 | |

| Cummins India Ltd | Industrial Products | 0.40 | -0.40 |

| Gillette India Ltd | Personal Products | ||

| Hindustan Aeronautics Ltd | Aerospace & Defense | ||

| Syngene International Ltd | Healthcare Services | 0.57 | -0.57 |

| Trent Ltd | Retailing | ||

| Nippon India ETF Gold Bees | Mutual Funds | 20.02 | |

| DSP Gold ETF | Mutual Funds | 14.92 | |

| HDFC Gold ETF | Mutual Funds | 14.21 | |

| ICICI Prudential Gold ETF | Mutual Funds | 8.62 | |

| 6.99% GOI (MD 17/04/2026) | Sovereign | 10.93 | |

| TREPS, Cash, Cash Equivalents and Net Current Asset | Cash & Cash Equivalents | 13.66 | |

| Grand Total | 100 |

(An open ended scheme investing in Equity, Fixed Income, Exchange Traded Commodity Derivatives / Units of Gold ETFs / Silver ETFs & units of REITs/InvITs)

This product is suitable for investors who are seeking* :

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

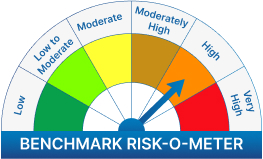

The risk of the scheme is moderately high

We will notify you once Samco Multi Asset Allocation Fund - Regular Growth opens for subscriptions.

Enter the OTP received on mobile number +91 ![]() Edit

Edit

Mutual fund investments are subject to market risks, read all scheme related documents carefully.