Samco Multi Cap Fund - Regular Growth

Samco Multi Cap Fund - Regular Growth

Fund Overview

Fund Overview

The investment objective of the scheme is to generate long term capital appreciation by investing in a portfolio of equity and equity related securities of large cap, midcap and small cap companies.

There is no assurance that the investment objective of the scheme will be achieved.

| Key Highlights | |||||||

|---|---|---|---|---|---|---|---|

|

|

Type of scheme

|

An open-ended scheme investing across large cap, midcap and small cap stocks

|

|

Plans

|

|

|

Benchmark Index

|

Nifty 500 Multicap 50:25:25 Total Returns Index

|

|

STP Frequency

|

|

|

Minimum Application Amount of scheme

|

₹ 5000 and in multiples of ₹ 1/- thereafter

|

|

Minimum Additional Application Amount

|

₹ 500 and in multiples of ₹ 1/- thereafter

|

|

Minimum SIP Amount

|

₹ 500 and in multiples of ₹ 1/- thereafter

|

|

Entry Load

|

Not applicable

|

|

Exit Load

|

|

Fund Manager

|

Mr. Umeshkumar MehtaDirector, CIO & Fund Manager

Ms. Nirali BhansaliCo-Fund Manager

Mr. Dhawal DhananiDedicated Fund Manager for overseas investments |

Portfolio

Portfolio| Issuers | Industry | % Of Net Assets | % to Derivatives |

|---|---|---|---|

| Ventive Hospitality Ltd | Leisure Services | 3.21 | |

| ICICI Bank Ltd | Banks | 1.98 | |

| Avanti Feeds Ltd | Food Products | 1.71 | |

| Sumitomo Chemical India Ltd | Fertilizers & Agrochemicals | 1.31 | |

| AstraZeneca Pharma India Ltd | Pharmaceuticals & Biotechnology | 1.29 | |

| Affle (India) Ltd | IT - Services | 1.27 | |

| Caplin Point Laboratories Ltd | Pharmaceuticals & Biotechnology | 1.26 | |

| Zensar Technologies Ltd | IT - Software | 1.26 | |

| Manappuram Finance Ltd | Finance | 1.24 | |

| 360 One WAM Ltd | Capital Markets | 1.20 | |

| Godawari Power And Ispat Ltd | Industrial Products | 1.15 | |

| Action Construction Equipment Ltd | Agricultural, Commercial & Construction Vehicles | 1.02 | |

| Gillette India Ltd | Personal Products | 0.96 | |

| UTI Asset Management Company Ltd | Capital Markets | 0.95 | |

| BLS International Services Ltd | Leisure Services | 0.91 | |

| Computer Age Management Services Ltd | Capital Markets | 0.90 | |

| eClerx Services Ltd | Commercial Services & Supplies | 0.89 | |

| Praj Industries Ltd | Industrial Manufacturing | 0.85 | |

| Triveni Turbine Ltd | Electrical Equipment | 0.84 | |

| Central Depository Services (India) Ltd | Capital Markets | 0.83 | |

| Motilal Oswal Financial Services Ltd | Capital Markets | 0.83 | |

| Persistent Systems Ltd | IT - Software | 1.48 | -0.75 |

| Newgen Software Technologies Ltd | IT - Software | 0.73 | |

| Bharti Airtel Ltd | Telecom - Services | 1.73 | -1.01 |

| Coforge Ltd | IT - Software | 1.62 | -0.90 |

| Solar Industries India Ltd | Chemicals & Petrochemicals | 0.84 | -0.12 |

| Kotak Mahindra Bank Ltd | Banks | 0.71 | |

| InterGlobe Aviation Ltd | Transport Services | 1.96 | -1.26 |

| Shree Cement Ltd | Cement & Cement Products | 1.68 | -0.98 |

| Bajaj Holdings & Investment Ltd | Finance | 0.69 | |

| Eicher Motors Ltd | Automobiles | 1.67 | -0.98 |

| HDFC Bank Ltd | Banks | 0.69 | |

| Vedanta Ltd | Diversified Metals | 1.75 | -1.07 |

| Bajaj Finance Ltd | Finance | 1.49 | -0.81 |

| Bharat Dynamics Ltd | Aerospace & Defense | 0.68 | |

| Coromandel International Ltd | Fertilizers & Agrochemicals | 0.68 | |

| Bharat Electronics Ltd | Aerospace & Defense | 1.68 | -1.00 |

| JSW Steel Ltd | Ferrous Metals | 1.68 | -1.00 |

| Marico Ltd | Agricultural Food & other Products | 1.54 | -0.87 |

| Abbott India Ltd | Pharmaceuticals & Biotechnology | 0.67 | |

| GlaxoSmithKline Pharmaceuticals Ltd | Pharmaceuticals & Biotechnology | 0.67 | |

| Hindustan Zinc Ltd | Non - Ferrous Metals | 0.67 | |

| Mazagon Dock Shipbuilders Ltd | Industrial Manufacturing | 0.67 | |

| Page Industries Ltd | Textiles & Apparels | 0.67 | |

| Divi's Laboratories Ltd | Pharmaceuticals & Biotechnology | 1.66 | -0.99 |

| Muthoot Finance Ltd | Finance | 1.75 | -1.09 |

| APL Apollo Tubes Ltd | Industrial Products | 1.67 | -1.01 |

| Bajaj Finserv Ltd | Finance | 1.51 | -0.85 |

| HDFC Asset Management Company Ltd | Capital Markets | 1.72 | -1.07 |

| Mahindra & Mahindra Ltd | Automobiles | 1.46 | -0.81 |

| Hindalco Industries Ltd | Non - Ferrous Metals | 0.65 | |

| K.P.R. Mill Ltd | Textiles & Apparels | 0.65 | |

| Torrent Pharmaceuticals Ltd | Pharmaceuticals & Biotechnology | 1.57 | -0.92 |

| Dixon Technologies (India) Ltd | Consumer Durables | 1.45 | -0.83 |

| Healthcare Global Enterprises Ltd | Healthcare Services | 0.57 | |

| Petronet LNG Ltd | Gas | 1.56 | -1.56 |

| 182 Days Tbill (MD 08/05/2025) | Sovereign | 7.20 | |

| TREPS, Cash, Cash Equivalents and Net Current Asset | Cash & Cash Equivalents | 43.95 | |

| Grand Total | 100 |

Frequently asked questions

Frequently asked questions

Multi cap funds are those which are required to hold at least 75% of their assets in equity and equity related instruments at any point in time. The portfolio must allocate at least 25% of its assets to large-cap, 25% to mid-cap, and another 25% to small-cap stocks.

Samco Multi Cap Fund is a 4 in 1 equity scheme that invests 25% across Large, Mid, Small caps and small cap companies beyond Nifty 500 with the investment objective of generating long term capital appreciation for investors. This 4-in-1 approach ensures diversified exposure to different market capitalizations.

The Samco Multi Cap Fund employs a proprietary stock selection algorithm focused on identifying stocks demonstrating trending price action and earnings momentum. This careful and dynamic stock selection process ensures the fund captures growth opportunities across different market capitalizations while managing risk effectively.

Samco Multi Cap Fund follows a 4-in-1 approach and maintains flexibility through an adaptive portfolio allocation. In challenging conditions such as bear markets, the fund may increase allocation to large caps for stability, use hedging strategies to mitigate risk, and invest in debt or money market instruments to ensure liquidity and preserve capital. This proactive approach ensures that the portfolio remains resilient and capable of capitalizing on emerging opportunities while minimizing downside risks.

Investors seeking stability of large businesses and at the same time aiming for higher alpha generation may consider Samco Multi Cap Fund.

The Scheme performance would be benchmarked against Nifty Multi Cap 50:25:25 TRI.

Dividends will not be declared by Samco Multi Cap Fund and only growth plan would be available.

Samco Multi Cap Fund - Regular Growth

Samco Multi Cap Fund - Regular Growth

(An open-ended scheme investing across large cap, midcap and small cap stocks)

This product is suitable for investors who are seeking* :

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

(The product labelling assigned during the New Fund Offer is based on internal assessment of the scheme characteristics or model portfolio and the same may vary post NFO when actual investments are made)

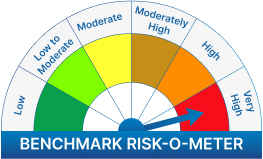

The risk of the scheme is moderate

We will notify you once Samco Multi Cap Fund - Regular Growth opens for subscriptions.

Enter the OTP received on mobile number +91 ![]() Edit

Edit

Mutual fund investments are subject to market risks, read all scheme related documents carefully.