Samco Special Opportunities Fund - Regular Growth

Samco Special Opportunities Fund - Regular Growth

Fund Overview

Fund Overview

The investment objective of the scheme is to achieve long-term capital appreciation by investing in a portfolio of securities that are involved in special situations such as restructurings, turnarounds, spin-offs, mergers & acquisitions, new trends, new & emerging sectors, digitization, premiumization, and other special corporate actions. These situations often create mispricings and undervalued opportunities that the fund aims to exploit for potential capital appreciation.

However, there can be no assurance or guarantee that the investment objective of the scheme would be achieved.

| Key Highlights |

|---|

| DISRUPTION Model - Unique Proprietary model for identifying special situations |

| Dynamic Flexibility - Portfolio of ideas across, sectors & situations without restrictions |

| Universe Agnostic - Special situations across market caps from Large to Microcaps |

| Tax Efficiency - Benefits of equity taxation |

| Diversification - Diversified portfolio across special situations, themes to mitigate risk |

|

Type of scheme

|

An open-ended equity scheme following special situations theme

|

|

Plans

|

|

|

Benchmark Index

|

NIFTY 500 TRI

|

|

STP Frequency

|

|

|

Minimum Application Amount of scheme

|

₹ 5000 and in multiples of ₹ 1/- thereafter

|

|

Minimum Additional Application Amount

|

₹ 500 and in multiples of ₹ 1/- thereafter

|

|

Minimum SIP Amount

|

₹ 500 and in multiples of ₹ 1/- thereafter

|

|

Entry Load

|

Not applicable

|

|

Exit Load

|

(With effect from October 03, 2024) |

Fund Manager

|

Mr. Umeshkumar MehtaDirector, CIO & Fund Manager

Ms. Nirali BhansaliCo-Fund Manager

Mr. Dhawal DhananiDedicated Fund Manager for overseas investments |

Portfolio

Portfolio| Issuers | Industry | % Of Net Assets |

|---|---|---|

| Religare Enterprises Ltd | Finance | 8.12 |

| Choice International Ltd | Finance | 3.59 |

| Healthcare Global Enterprises Ltd | Healthcare Services | 3.56 |

| Marathon Nextgen Realty Ltd | Realty | 3.51 |

| Fortis Healthcare Ltd | Healthcare Services | 3.11 |

| Radico Khaitan Ltd | Beverages | 2.98 |

| Coromandel International Ltd | Fertilizers & Agrochemicals | 2.93 |

| 360 One WAM Ltd | Capital Markets | 2.90 |

| Bajaj Holdings & Investment Ltd | Finance | 2.90 |

| Page Industries Ltd | Textiles & Apparels | 2.88 |

| GE Vernova T&D India Ltd | Electrical Equipment | 2.78 |

| Aditya Birla Sun Life AMC Ltd | Capital Markets | 2.73 |

| Nuvama Wealth Management Ltd | Capital Markets | 2.70 |

| Motilal Oswal Financial Services Ltd | Capital Markets | 2.63 |

| Blue Jet Healthcare Ltd | Pharmaceuticals & Biotechnology | 2.61 |

| UTI Asset Management Company Ltd | Capital Markets | 2.59 |

| Chambal Fertilizers & Chemicals Ltd | Fertilizers & Agrochemicals | 2.57 |

| Bajaj Finserv Ltd | Finance | 2.56 |

| Muthoot Finance Ltd | Finance | 2.56 |

| Ami Organics Ltd | Pharmaceuticals & Biotechnology | 2.54 |

| CG Power and Industrial Solutions Ltd | Electrical Equipment | 2.54 |

| Nippon Life India Asset Management Ltd | Capital Markets | 2.54 |

| FSN E-Commerce Ventures Ltd | Retailing | 2.53 |

| United Spirits Ltd | Beverages | 2.46 |

| Cartrade Tech Ltd | Retailing | 2.43 |

| Bajaj Finance Ltd | Finance | 2.42 |

| SBI Cards and Payment Services Ltd | Finance | 2.41 |

| Suven Pharmaceuticals Ltd | Pharmaceuticals & Biotechnology | 2.30 |

| Paradeep Phosphates Ltd | Fertilizers & Agrochemicals | 2.20 |

| United Breweries Ltd | Beverages | 2.20 |

| Gokaldas Exports Ltd | Textiles & Apparels | 2.18 |

| Hitachi Energy India Ltd | Electrical Equipment | 2.17 |

| Narayana Hrudayalaya Ltd | Healthcare Services | 2.10 |

| Zomato Ltd | Retailing | 2.07 |

| Arvind Ltd | Textiles & Apparels | 1.88 |

| TREPS, Cash, Cash Equivalents and Net Current Asset | Cash & Cash Equivalents | 2.82 |

| Grand Total | 100 |

Frequently asked questions

Frequently asked questions

Samco Special Opportunities Fund is an open-ended equity scheme with an investment objective to achieve long-term capital appreciation by investing in a portfolio of securities that are involved in special situations such as restructurings, turnarounds, spin-offs, mergers & acquisitions, new trends, new & emerging sectors, digitization, premiumization, and other special corporate actions which has the potential to create superior long-term risk adjusted returns.

The Samco Special Opportunities Fund employs a unique, proprietary “DISRUPTION” Model to identify investment opportunities. This model is based on 10 distinct sub-strategies (see image below), each designed to uncover special situations within diverse themes. This systematic approach enables the fund to generate a diverse range of investment ideas, leveraging disruption and special situations to seek out potential growth and value for investors.

| Strategy | Catalyst for price appreciation triggered by underlying revenue / profit growth |

|

|---|---|---|

| D | Digitization | Megatrend of Digital adoption |

| I | Insider Mirror Trading | Riding behind actions of Insiders |

| S | Spin Offs & Corporate Actions | Value unlocking due to simplification |

| R | Reforms - Regulatory, Governmental | Accelerated growth & improving efficiencies |

| U | Undervalued Holding Companies | Mean reversion of Holdco discount |

| P | Premiumisation | Rising standards of living of consumers |

| T | Trends sustainable over time | Tailwinds due to behaviour shifts |

| I | Innovation & Technological Disruptions | Product/Channel, etc Innovation |

| O | Organised Shift | Rapid Growth due to unorganized shift |

| N | New & Emerging Sectors | Under-ownership & low discovery |

The Samco Special Opportunities Fund demonstrates dynamic flexibility, crucial for navigating the ever-changing landscape of sectors and themes in the investment world. Its adaptability allows it to swiftly shift focus across diverse areas such as defence, energy, railways, pharmaceuticals, and infrastructure, capitalizing on the best opportunities as they emerge rather than sticking to just one theme. This strategic flexibility ensures that the fund can adapt to and thrive in the fluid nature of market trends, offering a robust advantage to investors seeking diversified exposure and potential growth across varied sector, for compounding their wealth.

The fund is designed to be universe agnostic, meaning it does not limit its investment scope to companies of a specific market capitalization. This strategy allows the fund to explore and capitalize on special situations across the entire market spectrum, from large-cap to micro-cap companies. By not confining itself to a particular segment, the fund is able to pursue a wide range of investment opportunities wherever they may arise, enhancing its potential for capital appreciation by tapping into diverse and sometimes underexplored areas of the market.

Samco Special Opportunities Fund is suitable for investors who are seeking long term capital appreciation through an actively managed thematic equity scheme that invests in stocks based on special situations theme.

Samco Special Opportunities Fund offers five distinct benefits:

For taxation purposes, Samco Special Opportunities Fund is treated as an equity scheme and taxed accordingly.

Short-term capital gains (STCG) tax: If you sell your units within 12 months of purchase, the capital gain will be classified as STCG, and tax will be levied at 15%.

Long-term capital gains (LTCG) tax: If you sell your units after 12 months of purchase, the capital gain will be classified as LTCG. Every financial year, the first Rs. 1 lakh long-term capital gain will be exempt from taxation. The incremental long-term capital gain above Rs.1 lakh will be taxed at 10%.

The Exit Load of Samco Special Opportunities Fund is as under:

There is no restriction on number of stocks in the fund. The scheme will focus on generating long-term capital growth by investing in companies that are experiencing or poised for special situations.

The Scheme performance would be benchmarked against NIFTY 500 TRI.

The fund has no specific target relating to portfolio turnover.

Dividends will not be declared by Samco Special Opportunities Fund and only growth plan would be available.

Samco Special Opportunities Fund - Regular Growth

Samco Special Opportunities Fund - Regular Growth

(An open-ended equity scheme following special situations theme)

This product is suitable for investors who are seeking* :

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

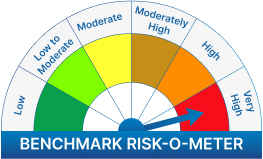

The risk of the scheme is very high

We will notify you once Samco Special Opportunities Fund - Regular Growth opens for subscriptions.

Enter the OTP received on mobile number +91 ![]() Edit

Edit

Mutual fund investments are subject to market risks, read all scheme related documents carefully.