Margin of Safety (MoS) is an investing principle in which investors purchase securities only

when their market price is significantly below their intrinsic value.

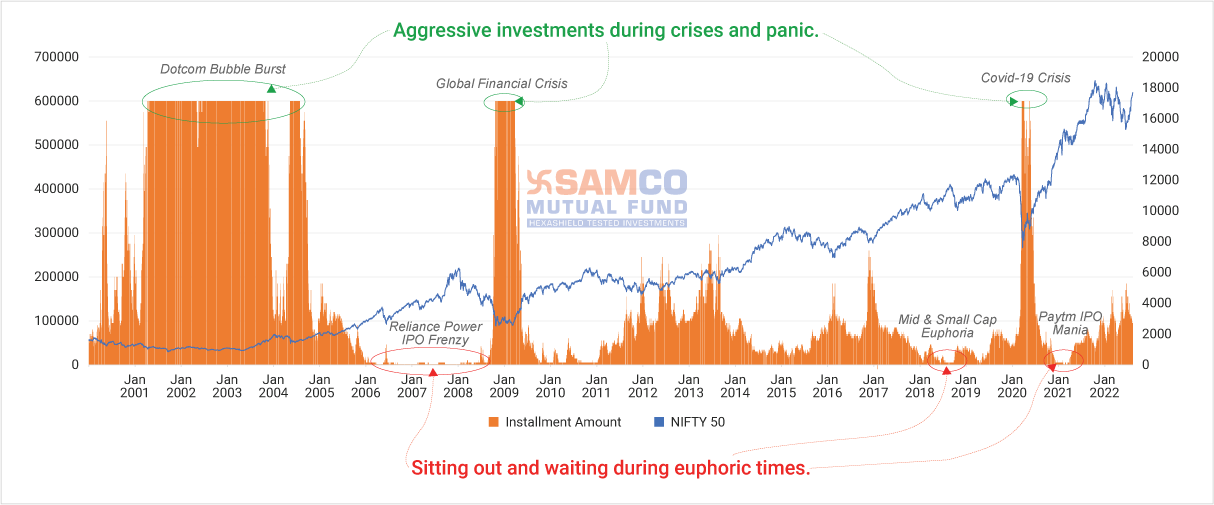

TimerSTP is a tool, powered by margin of safety, that determines the right time to invest more and the time to invest less in equities, with the help of Samco's proprietary Equity Margin of Safety Index (EMOSI) indicator. It helps you invest in the markets without any emotional bias, it eliminates the stress of tracking the markets constantly and endeavors to offers a higher reward/risk ratio.

Start TimerSTP Now

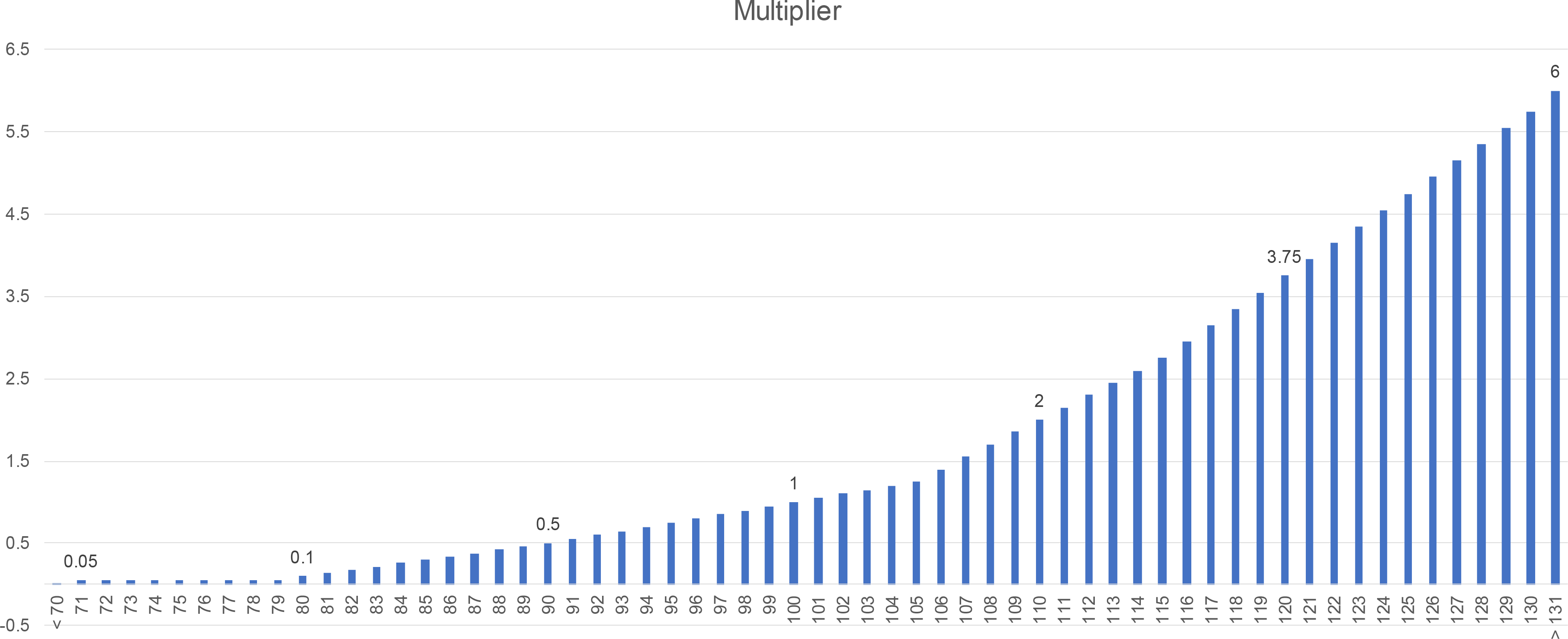

TimerSTP operates on Samco’s proprietary Equity Margin of Safety Index (EMOSI) indicator which is based on the margin of safety investing principle. It is represented by a range of values between 1-200 where 1 denotes the lowest margin of safety and 200 denotes the highest. EMOSI allows TimerSTP to transfer variable amounts ranging between 0.01X to 6X of base instalment via Systematic Transfer Plan (STP) approach from the source scheme to the target scheme depending upon the market levels and margin of safety.

Know More About EMOSITimerSTP transfers variable amounts from source scheme to target scheme based on the EMOSI value ranging between 1 to 200. As EMOSI value increases TimerSTP increases the equity allocation up to 6X of the base instalment and as EMOSI value decreases it limits the equity allocation as low as 0.01X* of the base instalment.

*Up to 0.01X or Rs.100, whichever is higher.

When the markets are high EMOSI allows TimerSTP to “invest cautiously” i.e. deduct lower multiples (up to 0.01X)* of the base instalment from the source scheme, thus minimising the equity exposure. Similarly, when markets are low, TimerSTP “invests aggressively” i.e deducts higher multiples (up to 6X) of the base instalment from the source scheme and transfers it to the target scheme, ensuring maximum equity exposure.

The chart shown above is only for illustrative purposes. The information contained herein should not be construed as forecast or promise of any return.

An illustration of how a Timer STP setup in Jan 2020 for Rs.12,00,000, in source scheme, would move to target scheme based on EMOSI.

| STP Date | EMOSI | Multiplier | Expected Amount (₹) transferred to Target | Actual Amount (₹) transferred to Target | Remaining Amount (₹) in Source |

|---|---|---|---|---|---|

| 2020-01-31 | 94 | 0.7 | 70,000.00 | 70,000.00 | 11,29,993.35 |

| 2020-02-28 | 101 | 1.05 | 1,05,000.00 | 1,05,000.00 | 10,38,548.14 |

| 2020-03-31 | 135 | 6 | 6,00,000.00 | 6,00,000.00 | 4,44,480.02 |

| 2020-04-30 | 118 | 3.35 | 3,35,000.00 | 3,35,000.00 | 1,11,346.00 |

| 2020-05-29 | 120 | 3.75 | 3,75,000.00 | 1,13,187.10 |

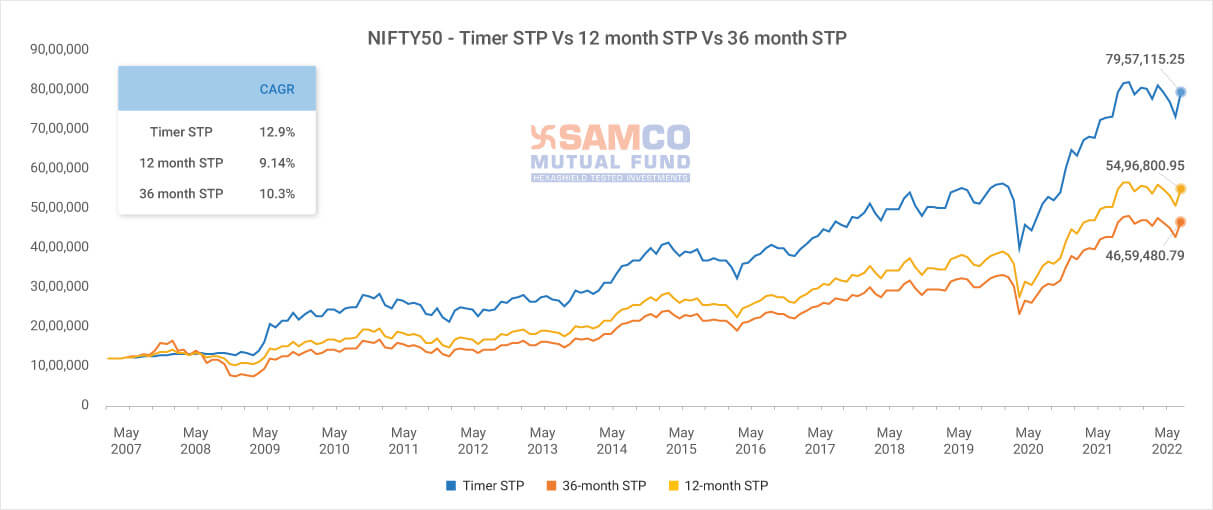

Source – Internal Research. Based on Back-tested data of rolling returns for STP setup in each month. For 36 month STP, 12 month STP and TimerSTP, Ending value are based on total return of source scheme i.e. Crisil Short Term Fund Index and Target Scheme - NIFTY 50. The above returns are of benchmark/index and do not indicate returns of any scheme. The lumpsum investment amount is Rs. 12,00,000 in Source Fund (Crisil Short Term Bond Index Fund) transferred through monthly Timer STP to Nifty50 Index. Timer STP is applied to Base Instalment amount is Rs. 1,00,000.

Source: Internal Research. Based on Back-tested data of the lumpsum investment amount of Rs. 12,00,000 in Source Fund (Crisil Short Term Bond Index Fund) transferred through monthly Timer STP to Nifty50 Index. Timer STP is applied to Base Instalment amount of Rs. 1,00,000. CAGR is calculated on both source and target schemes.

| Investment Period | Timer STP (% CAGR) | 36 month STP (% CAGR) | 12 month STP (% CAGR) | Alpha over 36 month STP (%) | Alpha over 12 month STP (%) |

|---|---|---|---|---|---|

| 3 Years | 13.46 | 8.22 | 9.28 | 5.24 | 4.18 |

| 5 Years | 11.60 | 8.33 | 8.95 | 3.27 | 2.65 |

| 10 Years | 8.96 | 7.35 | 7.65 | 1.61 | 1.31 |

| As on 31.07.2022 | 12.83 | 10.39 | 11.28 | 2.44 | 1.55 |

* Source – NSE, Refinitiv. Based on Back-tested data of rolling returns for STP setup in each month from January 2005 till July 2022. For 36 month STP, 12 month STP and TimerSTP, CAGR returns are based on total return of source scheme i.e. Crisil Short Term Fund Index and Target Scheme - NIFTY 50. The above returns are of benchmark/index and do not indicate returns of any scheme. CAGR = [(Ending Value/Beginning Value) ^ (1/No. of Years)]-1. The lumpsum investment amount is Rs. 12,00,000 in Source Fund transferred through monthly Timer STP to Nifty50 Index. Timer STP is applied to Base Instalment amount is Rs. 1,00,000. CAGR is calculated on both source and target schemes. Read more

# The TimerSTP multiplier is the multiplier applied to the base instalment amount. In case of regular 36 month and 12 month STP, the multiplier is default 1 as base amount. In case of TimerSTP, it shall be a number between 0.01 - 6. For Eg. If the base instalment amount is Rs. 100000, and the corresponding multiplier value is 0.01 on date of STP, then the amount that shall be transferred from Source Scheme to Target Scheme is Rs. 1000. If the multiplier is 6, then the amount that shall be transferred from Source Scheme to Target Scheme is Rs. 600000. The multiplier is linked to SAMCO’s proprietary Equity Margin of Safety Index which is derived from multiple factors such as Price to Earnings (PE), G-sec yields, moving average divergences and / or other fundamental and technical factors as may be determined by the AMC from time to time.

Disclaimer: All figures and other data given in this document are dated. The same may or may not be relevant at a future date. SAMCO AMC takes no responsibility of updating any data/information in this material from time to time. The information shall not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without prior written consent of SAMCO Asset Management Private Limited. Prospective investors are advised to consult their own legal, tax and financial advisors to determine possible tax, legal and other financial implication or consequence of subscribing to the units of SAMCO Mutual Fund. Past Performance may or may not be sustained in future.

In the preparation of the material contained in this document, SAMCO Asset Management Private Ltd. (the AMC) has used information that is publicly available, including government data and information developed in-house. The stock(s)/sector(s) mentioned in this slide do not constitute any recommendation and SAMCO Mutual Fund may or may not have any future position in this stock(s). Some of the material used in the document may have been obtained from members/persons other than the A M C and/or its affiliates and which may have been made available to the AMC and/or to its affiliates. Information gathered and material used in this document is believed to be from reliable sources. The AMC however does not warrant the accuracy, reasonableness and /or completeness of any information. We have included statements /opinions / recommendations in this document, which contain words, or phrases such as “will”, “expect”, “should”, “believe” and similar expressions or variations of such expressions, that are “forward looking statements”. Actual results may differ materially from those suggested by the forward looking statements due to risk or uncertainties associated with our expectations with respect to, but not limited to, exposure to market risks, general economic and political conditions in India and other countries globally, which have an impact on our services and/or investments, the monetary and interest policies of India, inflation, deflation, unanticipated turbulence in interest rates, foreign exchange rates, equity prices or other rates or prices etc. SAMCO AMC (including its affiliates), the Mutual Fund, The Trust and any of its officers, directors, personnel and employees, shall not liable for any loss, damage of any nature, including but not limited to direct, indirect, punitive, special, exemplary, consequential, as also any loss of profit in any way arising from the use of this material in any manner. Further, the information contained herein should not be construed as forecast or promise or investment advice. The recipient alone shall be fully responsible/are liable for any decision taken on this material. Please read terms & conditions in the application form before investing or visit www.samcomf.com. This facility should not be associated or confused with Systematic Transfer Plan, which is a separate facility provided by SAMCO AMC. Read less

SAMCO’s Timer Systematic Transfer Plan (TimerSTP / TSTP) is a solution wherein unit holder(s) can choose to transfer variable amount(s) from ‘Source Scheme’ to the ‘Target Equity Scheme’ at pre-defined intervals. TimerSTP will invest more when the markets are attractive and below their intrinsic value, similarly invest less when the markets are high and expensive. The amount(s) of transfer to the Target Scheme will be linked to the Equity Margin of Safety Index (EMOSI) as computed by the AMC on the date of respective transfer.

An investor must maintain minimum balance/ investment of Rs. 25,000/- in the opted source scheme at the time of registration of TimerSTP.

The Base Installment Amount is the installment amount that is mentioned while registering for TimerSTP. Minimum base instalment amount is Rs 1000 and in multiples of Re 1, but this is bare minimum amount, however it is recommended to mention base installment as 1/12 of the total amount to be transferred to the Target Equity Scheme. The processing of installment amount will be based on opted date/ day of multiplier of EMOSI value in case the base computation amount is less than Rs. 100, then the installment will be considered as Rs. 100. If arrived amount is in decimals the same will be rounding off in nearest rupee. For example, if an investor has invested Rs. 120,000 in source scheme, he can mention Rs. 10,000 (1/12 of target investment in the Equity Scheme) as base installment for monthly frequency of TimerSTP.

The Multiplier is the “Number of Times” of the installment amount to be transferred to target equity scheme. It will be within the range of “0.01X” to “6X” of the base installment. For example, If Investor registered TimerSTP with the base installment of Rs. 10,000, the multiplier amount can be from Rs. 100 (0.01X multiplier) to Rs. 60,000 (6X multiplier).

The amount of transfer to the target equity scheme is based on the latest Equity Margin of Safety Index (EMOSI) levels which is a proprietary model of Samco Asset Management Pvt Limited (the AMC). However, in any case the TimerSTP instalment amount will not exceed 6x of the base instalment amount as per the multiplier selected.

Equity Margin of Safety Index (EMOSI) levels computed by the AMC is a proprietary model of Samco Asset Management Pvt Limited (the AMC). The EMOSI is derived by assigning different weights such as Price to Earnings (PE), G-sec yields, moving average divergences and / or other fundamental and technical factors as may be determined by the AMC from time to time.

The investors have option of Weekly, Monthly and Quarterly frequency for transfer of funds from the eligible source schemes to eligible target equity schemes.

In such a case the TimerSTP will be registered (the default) till December 31, 2099.

Target Amount is the maximum amount the investor wishes to transfer from the Source Scheme to the Target Equity Scheme. When the cumulative installments through the TimerSTP reaches the Target Amount, TimerSTP will automatically cease.

No. The Investors may choose (1) Target Amount or (2) No of installments or (3) End date in the form. If this information is not provided / incomplete, the TimerSTP will be registered by default till 31-Dec-2099.

| EMOSI value | Multiplier on Base Instalment amount to be transferred | EMOSI value | Multiplier on Base Instalment amount to be transferred |

|---|---|---|---|

| =<70 | 0.01x | 101 | 1.05x |

| 70 | 0.01x | 102 | 1.10x |

| 71 | 0.05x | 103 | 1.15x |

| 72 | 0.05x | 104 | 1.20x |

| 73 | 0.05x | 105 | 1.25x |

| 74 | 0.05x | 106 | 1.40x |

| 75 | 0.05x | 107 | 1.55x |

| 76 | 0.05x | 108 | 1.70x |

| 77 | 0.05x | 109 | 1.85x |

| 78 | 0.05x | 110 | 2.00x |

| 79 | 0.05x | 111 | 2.15x |

| 80 | 0.10x | 112 | 2.30x |

| 81 | 0.14x | 113 | 2.45x |

| 82 | 0.18x | 114 | 2.60x |

| 83 | 0.22x | 115 | 2.75x |

| 84 | 0.26x | 116 | 2.95x |

| 85 | 0.30x | 117 | 3.15x |

| 86 | 0.34x | 118 | 3.35x |

| 87 | 0.38x | 119 | 3.55x |

| 88 | 0.42x | 120 | 3.75x |

| 89 | 0.46x | 121 | 3.95x |

| 90 | 0.50x | 122 | 4.15x |

| 91 | 0.55x | 123 | 4.35x |

| 92 | 0.60x | 124 | 4.55x |

| 93 | 0.65x | 125 | 4.75x |

| 94 | 0.70x | 126 | 4.95x |

| 95 | 0.75x | 127 | 5.15x |

| 96 | 0.80x | 128 | 5.35x |

| 97 | 0.85x | 129 | 5.55x |

| 98 | 0.90x | 130 | 5.75x |

| 99 | 0.95x | 131 | 6.00x |

| 100 | 1x | 131 | 6.00x |

Note: In case multiplier on base computation amount is less than Rs. 100, then the installment will be considered as Rs. 100. The TimerSTP transactions will be executed based on latest day EMOSI value available.

In TimerSTP, the minimum value of the installment can be 0.01X times multiplier of the base installment amount (i.e. when the margin of safety is the least) or Rs. 100 whichever is higher and can go up to 6X times multiplier of the base installment amount (i.e. when the margin of safety is the most).

Minimum number of installments in all frequencies will be 12.

Only one registration per target equity scheme in a folio would be allowed. In case of any existing registration (normal STP or TimerSTP) then new registration request shall be rejected.

Yes. Multiple TimerSTPs from the same source scheme to a different Target Equity Scheme would be allowed.

No. Only one registration per target equity scheme in a folio would be allowed. In case of any existing registration (normal STP or TimerSTP) then new registration request shall be rejected.

If the outstanding balance in the source scheme in investor’s folio is less than the amount to be transferred on the date of TimerSTP, the amount so transferred will be restricted to the balance available. In case of nil balance in the Source Scheme, TimerSTP installment for that particular due date will not be processed and TimerSTP will cease upon five consecutive unsuccessful transactions.

No, the Target Equity Scheme cannot be changed during the period. If Investor wants to change the Target Scheme, existing STP/TimerSTP to be cancel and register a new TimerSTP.

Investor can redeem existing holding from source scheme however, if the outstanding balance in the source scheme in investor’s folio is less than the amount to be transferred on the date of TimerSTP, the amount so transferred will be restricted to the balance available. In case of nil balance in the Source Scheme, TimerSTP installment for that particular due date will not be processed and TimerSTP will cease upon five consecutive unsuccessful transactions.

Investor can redeem existing holding from target scheme.

Yes, Investor can cancel TimerSTP by giving 7 (seven) business days prior request of the instalment date. The cancelation request can be submitted any of the to the Investor Service Centres.

Under Normal STP, a fixed amount is invested at the pre-defined intervals irrespective of the market conditions, whether the market is at peak or bottom.

However, under TimerSTP, a variable amount is invested will be linked to the EMOSI as computed by the AMC on the date of respective transfer.

Here's an illustration of how a transfer will be made from Source Scheme to Target Scheme:

For example, if the EMOSI on November 10, 2022, is 115, matrix defines a transfer of 2.75x of the base instalment amount. (1,000 *2.75), Rs. 2,750 will be transferred from Samco Overnight Fund with the applicable NAV of 10th November 2022 and invested in Samco Flexi Cap Fund with applicable NAV of 11th November 2022.

For example, if the EMOSI on December 10, 2022, is 90, matrix defines a transfer of 0.5x of the base instalment amount (1,000*0.5), Rs. 500 will be transferred from Samco Overnight Fund with the applicable NAV of 10th December 2022 and invested in Samco Flexi Cap Fund with applicable NAV of 11th December 2022.

Yes, however the registrations will done only till the date of minor attaining majority, even if the instructions may be for a period beyond that date. After attaining majority, the investor is required to re-register for TimerSTP.

No, TimerSTP will not be registered if the source scheme units are held in demat mode.

| EMOSI value | Multiplier on Base Instalment amount to be transferred | EMOSI value | Multiplier on Base Instalment amount to be transferred |

|---|---|---|---|

| =&<70 | 0.01x | 101 | 1.05x |

| 71 | 0.05x | 102 | 1.10x |

| 72 | 0.05x | 103 | 1.15x |

| 73 | 0.05x | 104 | 1.20x |

| 75 | 0.05x | 106 | 1.40x |

| 76 | 0.05x | 107 | 1.55x |

| 77 | 0.05x | 108 | 1.70x |

| 78 | 0.05x | 109 | 1.85x |

| 79 | 0.05x | 110 | 2.00x |

| 80 | 0.10x | 111 | 2.15x |

| 81 | 0.14x | 112 | 2.30x |

| 82 | 0.18x | 113 | 2.45x |

| 83 | 0.22x | 114 | 2.60x |

| 84 | 0.26x | 115 | 2.75x |

| 85 | 0.30x | 116 | 2.95x |

| 86 | 0.34x | 117 | 3.15x |

| 87 | 0.38x | 118 | 3.35x |

| 88 | 0.42x | 119 | 3.55x |

| 89 | 0.46x | 120 | 3.75x |

| 90 | 0.50x | 121 | 3.95x |

| 91 | 0.55x | 122 | 4.15x |

| 92 | 0.60x | 123 | 4.35x |

| 93 | 0.65x | 124 | 4.55x |

| 95 | 0.75x | 126 | 4.95x |

| 96 | 0.80x | 127 | 5.15x |

| 97 | 0.85x | 128 | 5.35x |

| 98 | 0.90x | 129 | 5.55x |

| 99 | 0.95x | 130 | 5.75x |

| 100 | 1.00x | =&> 131 | 6.00x |

| In case multiplier on base computation amount is less than Rs. 100, then the installment will be considered as Rs. 100. | |||

| TSTP date | Assumed EMOSI value | Multiplier on Base instalment Amount | Transfer Amount (Rs) |

|---|---|---|---|

| (A) | (B) | (C) | (D) |

| 10-Nov-22 | 115 | 2.75x | 2,750 |

| 10-Dec-22 | 90 | 0.50 | 500 |

| 10-Jan-23 | 120 | 3.75x | 3,750 |

| 10-Feb-23 | 127 | 5.15x | 5,150 |

| 10-Mar-23 | 150 | 6.00x | 6,000 |

| 10-Apr-23 | 130 | 5.75x | 5,750 |

| 10-May-23 | 119 | 3.55x | 3,550 |

| 10-Jun-23 | 106 | 1.40x | 1,400 |

| 10-Jul-23 | 100 | 1.00x | 1,000 |

| 10-Aug-23 | 95 | 0.75x | 750 |

| 10-Sep-23 | 90 | 0.50x | 500 |

| 10-Oct-23 | 85 | 0.30x | 300 |

| 10-Nov-23 | 60 | 0.01x | 100 |

| 10-Dec-23 | 82 | 0.18x | 180 |

| 10-Jan-24 | 96 | 0.80x | 800 |

The above table is for illustrative purposes only

Mutual fund investments are subject to market risks, read all scheme related documents carefully.