A systematic investment plan, or SIP, is one of the most loved and used investment strategies in mutual funds. The aim of a SIP is to simplify an investor’s journey as it allows them to buy units by investing a modest amount rather than having to invest a large sum all at once.

Invest Small Amount

Invest Small Amount  Monthly SIP auto pay

Monthly SIP auto pay  No worry about market ups and downs

No worry about market ups and downs In a SIP, a fixed amount is debited from the investor's bank account as per their chosen frequency - weekly, monthly, or half-yearly. In a SIP, investors get units based on the current NAV. NAV is the price at which units of a mutual fund are bought and sold. The NAV of a mutual fund scheme is adjusted on a daily basis.

SIPs make an investor’s job easy because they don't have to worry about market volatility. This is because SIPs facilitate rupee cost averaging. When the NAV of a fund increases, investors receive less units. On the contrary, when the fund’s NAV falls, investors receive more units. As a result, the average cost per unit is lower than the lumpsum investment made by investors.

Investing in mutual funds through a systematic investment plan (SIP) was created with a simple philosophy in mind -

With a SIP, mutual fund houses have made it possible for everyone to start investing without worrying about the minimum amount for investment. In addition to inclusivity, a SIP also has the following advantages -

Power of Compounding In power of compounding you earn return on your return i.e. the returns earned by you on your principle amount is reinvested in the same scheme. Here is a simple example to demonstrate the wealth created with and without the power of compounding.

Ram invested Rs 1 Lakh for 10 years earning a 12% (assumed) return on investments. The diagram below shows the returns Ram would make with and without the power of compounding.

| Year | Principal Amount | Interest@12% |

| 1 | 100,000 | 12,000 |

| 2 | 112,000 | 13,440 |

| 3 | 125,440 | 15,053 |

| 4 | 140,493 | 16,859 |

| 5 | 157,352 | 18,882 |

| 6 | 176,234 | 21,148 |

| 7 | 197,382 | 23,686 |

| 8 | 221,068 | 26,528 |

| 9 | 247,596 | 29,712 |

| 10 | 277,308 | 33,277 |

| Year | Principal Amount | Interest@12% |

| 1 | 100,000 | 12,000 |

| 2 | 100,000 | 12,000 |

| 3 | 100,000 | 12,000 |

| 4 | 100,000 | 12,000 |

| 5 | 100,000 | 12,000 |

| 6 | 100,000 | 12,000 |

| 7 | 100,000 | 12,000 |

| 8 | 100,000 | 12,000 |

| 9 | 100,000 | 12,000 |

| 10 | 100,000 | 12,000 |

The above illustration is provided to understand the power of compounding. Mutual Fund do not assure or guarantee any returns.

By leveraging the power of compounding, Ram was able to accumulate a corpus of Rs 3,10,584 in a period of 10 years. On the contrary, without the power of compounding, Ram’s savings would be worth a meagre Rs 2,10,584 only. Mutual funds facilitate power of compounding and helps you multiply your wealth manifolds.

Begin with as little as ₹500 every month With SIP you can invest in mutual funds with as little as ₹500. And even after starting small, you can accumulate a mammoth corpus. Let’s understand the magic of starting small with an example - Shyam started a SIP of ₹500 every month for next 30 years and earned a CAGR of 12% on his investments. The total amount invested is Rs ₹1, 80,000. The future value of his investments after 30 years will be ₹17, 64,957.

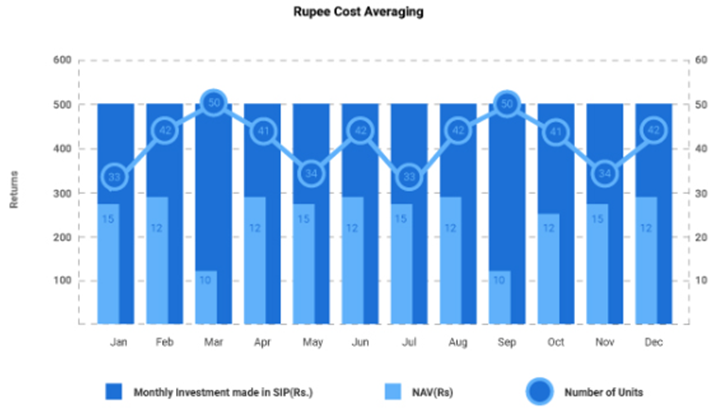

Rupee Cost Averaging With help of rupee cost averaging, investors can invest irrespectively of the market ups and downs. This results in high potential return over the long term. With rupee cost averaging, you gain more units when the market is down and less units when the market is up. Let understand it with an example: Shyam is investing ₹10,000 for six months in equity mutual fund through SIP. During this time, the markets witnessed its fair share of ups and downs. At the end of the six month period, his investments looked as follows -

| Months | Amount | NAV | No.of Units |

| January | 10,000 | 100 | 100 |

| February | 10,000 | 100 | 100 |

| March | 10,000 | 90 | 111.11 |

| April | 10,000 | 110 | 90.91 |

| May | 10,000 | 98 | 102.04 |

| June | 10,000 | 100 | 100 |

| Total | 60,000 | 598 | 604.06 |

Since Shyam decided to invest via SIPs and not lumpsum, he accumulated 604.06 units at an average price of Rs 99.32. Now if he had invested the entire ₹ 60,000 as lumpsum in January then his cost per unit would be Rs 100 and he would have accumulated only 600 units. So essentially, Shyam accumulated more units via a SIP than lumpsum investing.

Create Discipline Investing via SIP creates discipline among the investors, which results in better money management.

Flexible You can stop your SIP at any time and you can also withdraw from your collected corpus at any time (assuming these units are not in their lock-in period). Lock-in period is a time period within which investors are not allowed to redeem their investments. This is usually done with the intention to discourage investors from redeeming their investments too soon

When you register for a SIP, you are going to buy mutual fund units in tranches. Units are sold based on the prevailing NAV. Think of NAV as the purchase price of the goods and services. So if you pay ₹10 for a book, then the NAV of the book is ₹10. While the concept of NAV remains the same, it is important to note that NAV changes on a daily basis.

Let's assume that Ram wants to start a SIP of ₹5,000 in Samco Flexi Cap Fund. The fund’s NAV is 9.73 as on 26th April 2022. So, Ram will get 513.87 units (₹5,000/9.73). Now, the NAV of the fund increases to ₹10.20 on 30th April 2022. In the next installment, Ram will get 490.20 units (Rs 5,000/10.20).

To summarise

| SIP | Lumpsum |

| Systematic investment plan allows investors to invest a specific amount in mutual funds at regular intervals. In this case, the amount is debited directly from the investors' bank accounts. | In lumpsum investing, investors invest a large amount of money at once. This method is usually adopted by investors who have idle funds with them. |

| SIP helps to earn better returns when the market is low. | Lumpsum helps to earn better when the market is high. |

| SIP enjoys the benefit of the rupee cost average. | Lumpsum doesn't provide the benefits of rupee cost average. |

| With SIP you can invest as low as ₹500 | In the case of lumpsum, you must have a huge amount of funds available in order to invest. |

You must have often heard from friends, families and even from the advertisements on TV that SIPs are great for retail investors. But have you ever wondered, exactly what are the benefits of a SIP? This is precisely the question we will attempt to answer in this post. Let us understand the key benefits of a SIP.

Here are some of the benefits that have sparked investors' interest in SIPs.

Investment Friendly: SIP is a good option for investors who don't have enough money to invest in mutual funds at one go. You can begin your financial journey with SIP by investing as little as ₹500 per month. SIP is not only simple to track, but it also helps you maintain discipline while investing.

Easiest way of investing: SIP is one of the easiest ways of investment. If you want to start your investment journey but have no idea what the stock market is, or how to select stocks, then SIP in a mutual fund is the most effective approach to begin your investment trip Setting up a SIP is extremely easy. All you have to do is select the scheme in which you want to start your SIP, fill the NACH form which will instruct your bank to debit a fixed amount of rupees every month from your account and you are done!

Emergency Fund: As you are investing in an open-ended fund, you have the flexibility to withdraw your invested amount at any point of time. This is especially useful during emergencies.

Power of Compounding: Power of compounding has the potential to boost your investment returns over a long period of time. It helps you accumulate a higher corpus using the principle of compound interest. In simpler terms, you earn interest on your already accumulated interest which is reinvested back into the scheme. To gain maximum benefit from the power of compounding, you must start your investment journey at an early age and stay invested for a long time.

Here is an example which will help you understand the power of compounding better. Let’s assume you invest a certain amount every month at a 15% interest rate. This is what your returns will look like.

| SIP Amount | Rate of Return | Time Frame | Invested Corpus | Future Value |

| Rs. 1,000 | 15% | 30 years | Rs. 3,60,000 | Rs. 70,09,821 |

| Rs. 2,000 | 15% | 30 years | Rs. 7,20,000 | Rs. 140,19,641 |

| Rs. 5,000 | 15% | 30 years | Rs. 18,00,000 | Rs. 3,50,49,103 |

| Rs. 10,000 | 15% | 30 years | Rs. 36,00,000 | Rs. 7,00,98,206 |

If you start investing ₹1,000 per month for next 30 years, then your corpus would be worth Rs ₹70 lakhs on a mere investment of ₹3.60 lakhs. On the other hand, if you invest ₹10,000 per month for next 30 years then you could receive corpus of ₹7 Crores on a mere investment of ₹36 lakhs. This is the power of compounding. However, please note that, Mutual Fund do not assured or guarantee any returns.

Rupee Cost Average: SIP helps investors to invest in mutual funds without worrying about market ups and downs. In a SIP, you keep investing a fixed amount of money every month irrespective of the highs and lows of the market. So if the NAV is high that means an investor will be allotted fewer units and when the NAV is low, investors will be allotted more units. Let’s understand it with an example:

Assume Ram has started an SIP of ₹500 per month for 12 months. This is how rupee cost average will work for him.

Now you can average out the total purchase cost of the mutual fund units through SIP over a period of time and your average cost will be much lower than the investor who has invested in a mutual fund through lumpsum.

Discipline: SIP is well known among investors as it creates a disciplined habit of investing regularly. With SIP, a predetermined amount is automatically deducted every month from the investor's bank account. Once an investor starts SIP, the investment is not dependent on the willingness of the investor. The investment keeps happening every month without any interruption. SIP creates a healthy habit of saving regularly in order to meet your future financial goal.

Volatility: SIP shields its investors from market fluctuations. On a daily basis, the stock market experiences a lot of volatility. When the stock market falls and rises dramatically, this is known as volatility. Market Volatility do not cause any harm to SIP investment.

Flexibility: SIP is one of the most flexible investment options available. With the help of SIP, you can start your investment in any mutual fund scheme. Not only that you can also withdraw your investment at any time as they all are open-ended mutual funds which means you are not restricted to be invested for a particular period of time. You also have the flexibility with regards to the investment amount. You can increase or decrease the investment amount as per your requirement.

Better Return: As compared to the returns generated from traditional investment products, SIP has created amazing returns in the past. However, please note that, the past performance may or may not sustained in the future.

Top-up investment: SIP Top-up is a facility provided to all SIP investors where they have the freedom to invest a lumpsum amount in the same mutual fund in which they are doing their SIP, whenever they feel like it. Here is an estimated return earned if you invest in SIP with and without top-up.

| SIP Type | Amount | Annual Top Up % | SIP Tenure | Total Amount Investment | Corpus Value at end |

| Normal SIP | 20,000 | 0 | 20 yrs | Rs. 48.00 Lakhs | Rs. 1.75 Crores |

| SIP - Top Up | 20,000 | 10 | 20 yrs | Rs. 93.60 Lakhs | Rs. 2.82 Crores |

These are the 10 amazing benefits of a Systematic investment plan.

Have you ever visited a furniture shop to buy a chair? What is your thought-process? What do you look for in a chair? Apart from the shape, size, and color, the main thing you would check is if the chair suits your comfort. Is it durable? Similarly, when it comes to investing in mutual funds, you must consider a variety of factors to evaluate if a mutual fund meets all your requirements. How do you choose the best mutual fund for SIP? Here are a few basic things to keep in mind when selecting the best mutual fund schemes.

Financial Goals: It's very crucial to ensure that the mutual fund in which you are investing has a similar goal or investment objective as you. The best way to judge this is to list down all your requirements and match them with the investment objective of the fund. If both your requirements and mutual funds’ objectives match, then you can start a SIP in that mutual fund scheme.

Risk bearing capacity: Every investor has a different risk appetite. You must only invest in a mutual fund scheme, if its risk profile matches your risk appetite. For example, if you are a low-risk investor, then mid and small cap funds might not be the ideal fit. On the other hand, if you are a high-risk taker, then you can invest in moderate to high risk funds like multi-cap or midcap funds. If you are a conservative investor, then debt funds or large cap funds would suit you better.

Duration of SIP in Mutual Fund: Duration of investment in SIP depends upon 2 factors.

If you are investing in SIP to achieve a purpose, then you already know how long you have to stay invested. But if there is no specific purpose or goal and you only want to create wealth, then you must be invested for at least a period of five years. In mutual funds, the longer your investment horizon, the higher returns you generate.

Asset under Management: While selecting the best schemes for SIP, consider only those mutual funds which have an asset under management of more than ₹500 crore. This helps you ward-off volatility brought on by unexpected redemption pressures.

Reputation of the Mutual Fund House: The reputation of the mutual fund house plays an important role while selecting the best mutual fund scheme for SIP. The track record of a mutual fund house tells you a lot about their ability to handle market ups and downs, how they invest, how they manage investors' money, and how they have performed in the past. Investment done with reputed mutual fund houses, with established research methodology reduces your tension to a certain extent.

Robust Stock Selection over Star Fund Manager: To be honest, this isn’t as important as other factors. Why? Because if the fund house follows robust investment processes, then it doesn’t really matter who manages the fund. A major concern here is if the fund is over-reliant on star fund managers without having a robust stock selection process. In such cases, losing the fund manager would be a big deal. So instead of chasing after star fund managers, chase star fund processes.

Expense Ratio: Expense ratio also plays an important role while selecting the best mutual fund scheme for SIP. As specified by the Securities and Exchange Board of India (SEBI), mutual fund houses cannot charge more than 2.50% expense ratio for actively managed equity funds. Remember, the higher the expense ratio, the lower your overall returns from the fund.

Exit Load: SIP is only possible with open-ended mutual funds. So, open-ended mutual funds provide you with the flexibility of withdrawing your investment at any period of time. But there is a catch … every mutual fund scheme has an exit load. This means if you withdraw your investment before a specific period of time, then you will be charged with an exit load. Exit load is charged in order to discourage investors of investing in mutual fund for short period of time.

Turnover Ratio: While identifying best mutual fund schemes for SIP, evaluating the turnover ratio is very important. Turnover ratio is the rate at which the fund manager buys and sells the underlying stocks. The higher the turnover ratio, the more you pay as transaction cost as a unitholder. This might be a result of lack of faith in stock selection, which is detrimental for investors.

Risk-Adjusted Returns: This shows the return generated by a fund against the risk it takes. The two most common risk-adjusted return ratios are Sharpe ratio and Sortino ratio.

Sharpe ratio basically measures how much return an investor is getting in correlation to the level of risk taken by the fund. Ideally, a higher Sharpe ratio is favorable.

Sortino Ratio: The risk-adjusted return of an investment asset, portfolio, or strategy is measured by the Sortino ratio. It's a variant of the Sharpe ratio that only penalises returns that go below a user-specified target or needed rate of return, whereas the Sharpe ratio penalises both upside and downside volatility equally.

Alpha: Alpha is another risk-adjusted indicator of an investment's performance. It compares the risk-adjusted performance of an asset or fund portfolio to a benchmark index based on volatility. An investment's alpha is its excess return over the return of the benchmark index.

Assets Under Management of the Fund: AUM of a fund is the total amount of investment done by all the unitholders in a particular scheme. The AUM of the fund plays an important role while selecting the right mutual fund as a high AUM is a sign of stability. When the AUM of the scheme is low it means that there is low interest in the scheme. But this should be considered only once the fund has completed three to five years of existence.

Taxation: Your SIP is taxed in two ways -

In long term capital tax investor has to stay invested in the particular mutual fund for more than one year, and if his capital gain is less than Rs 1 Lakh, then they don’t have to pay any taxation.

But in case of short term capital gains, if the investor redeems the investment before completing one year, then they have to pay a tax of 15% on the capital gains.

Consistency in performance: Mutual funds that have a consistent track record are ideal for investment. The fund should consistently beat its benchmark and not be a one-hit wonder.

These were the few important factors to keep in mind while selecting the best mutual funds for SIP.

SIP or Systematic Investment Plan is an investment option offered by mutual fund houses to investors where you can invest a small amount every month instead of investing everything at one go.

A SIP only has to be registered just once, thereafter it is automatically debited from your bank account on a specific date. You can start SIP with as low as Rs 100. Each SIP investment is counted as a new investment for taxation purposes.

There are many benefits that you enjoy when you start SIP. Here are the key benefits of a systematic investment plan -

Start investment with just Rs 500: You can start investing in your favorite mutual funds through SIP with just Rs 500.

Start investment with just Rs 500: You can start investing in your favorite mutual funds through SIP with just Rs 500.

![]() Power of compounding: : By starting a SIP, you enjoy the power of compounding where you earn interest on accumulated balance...

Power of compounding: : By starting a SIP, you enjoy the power of compounding where you earn interest on accumulated balance...

![]() Rupee cost average: : Rupee cost averaging plays an important role when you are creating wealth with SIP. By buying at different market prices, you average out your overall purchase cost in the long run.

Rupee cost average: : Rupee cost averaging plays an important role when you are creating wealth with SIP. By buying at different market prices, you average out your overall purchase cost in the long run.

Before we tell you how to invest in SIP, there is something else you must know. Here are the things to consider before we reveal how to invest in SIP.

Why you want to invest: First you must know the reason why you are starting the SIP. Once you have a clear vision of your goal then it becomes easier for you to begin and stick to your investments.

How much you should invest: The answer to this question lies in the first point. Once you figure out what your goals are, then you must assign a value to your goals. For example, buying a car worth Rs 5 Lakhs, plan for an international vacation costing Rs 3 Lakhs etc. Once you know the target amount, you can easily figure out how much you should invest every month using an SIP calculator.

Best time to invest in SIP: There is no such thing as the best time to invest in SIP. Whenever you realize the importance of savings and investing is the best time to invest in SIP. A quick hack to ensure disciplined investing is to select an SIP date which is immediately after your salary date. This way you will invest before spending.

In which mutual fund you must invest in: There are numerous options available. But you must only start your SIP in a mutual fund whose objective and risking taking abilities match yours.

Regular Plan Vs Direct Plan: in mutual funds you have two options for investment - regular plan and direct plan.

The biggest difference between direct and regular plan is that in direct plan you invest in the scheme directly with the Asset Management Company (AMC) or the mutual fund house. In direct plans, there is no involvement of a third party like broker or agent or advisor. In case of regular plan, you purchase the scheme through a third party entity like distributor, broker or adviser.

Another difference between regular and direct plan is expense ratio, which includes allocation charges, advertisement cost, operation cost, management cost, etc in short expenses in results in promoting the scheme.

Growth Option Vs Dividend Option: There are 2 types of options able in mutual funds - growth and dividend options. In growth option, the profit made by the scheme is reinvested in the same scheme again. This helps in compounding your wealth...

In case of dividend option, the profits which are made by the mutual fund scheme will be paid to the investors on a daily, weekly, or monthly basis.

After figuring out the above answers, here is a step-by-step process on how to invest in SIP.

Before you understand the process of investing in SIP, you must complete your KYC (Know Your Customer) formality. The basic documents required for KYC are:

PAN card

Address Proof (Aadhaar, passport, voter ID, utility bill, driving licence, etc.)

Your photograph (passport size)

You signature on a paper

Bank Proof (Cancelled cheque, bank passbook, bank statement)

Once you have all these documents and your KYC is done, the actual account opening process will begin.

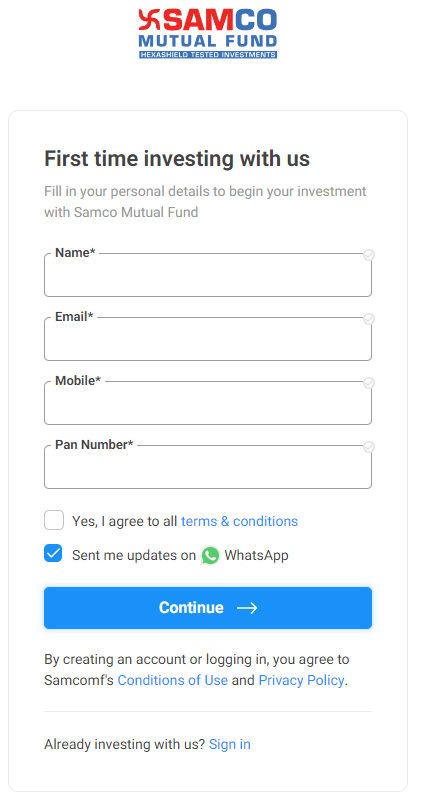

Step 1: Open an account:

First, visit www.samcomf.com

Then click on New Investor button.

Now you will see a form which says first time investing with us. Here, you have to fill your basic details like Name, Email, and Mobile Number and PAN details.

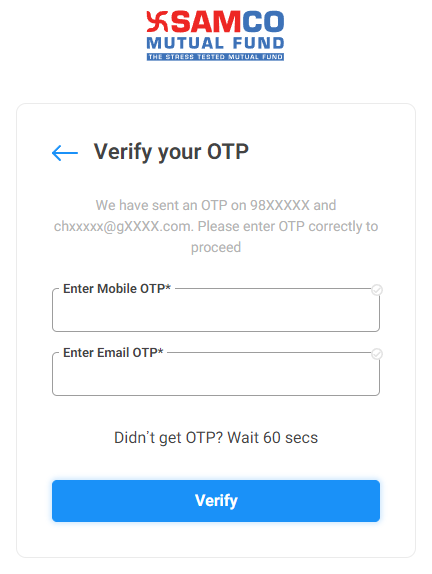

Then on next page you have to verify your OTP.

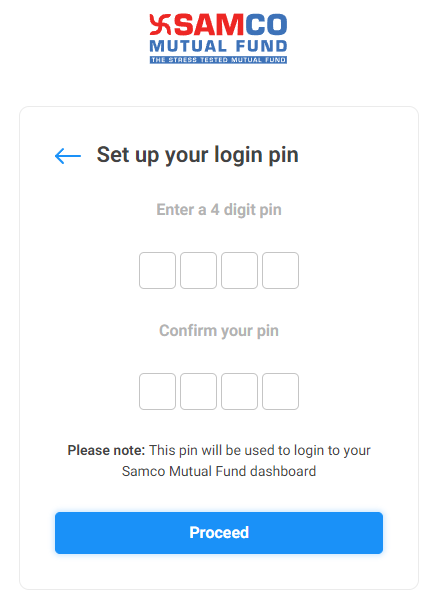

Then you have to set up your login pin.

Now you will have to fill details to create your portfolio.

If your KYC process is already completed then you have to fill basic information.

If your KYC process is not completed then you have to fill and upload some additional documents mentioned above.

After filling KYC documents it will take 2-3 business days to open your account.

If your KYC process is already completed than your account will open immediately.

Step 2: Select the Scheme

You will see Samco Flexi Cap Fund, choose from direct or regular plan, then select SIP, the date you want, and then enter the amount you want to invest every month.

Step 3 : Set you E-Mandate

Now you have to set up an e-mandate. This is very important in SIP as you invest in a scheme every month. In order to not to miss your next SIP filling the e-mandate form is necessary. It helps the mutual fund house to auto debit from your bank account on the selected SIP date without any hassles.

That’s all you need to know about how to invest in SIP.

SIP has gained a lot of popularity in the past few years. Some expected that the introduction of long term capital gains tax in the year of 2018 will lead to a decrease in SIP inflows. But there has been absolutely no effect of taxation on the popularity of SIPs. Unfortunately, a lot of investors are still unaware about SIP taxation. So, while a majority of investors are investing in mutual funds through SIP, only a handful are aware about SIP taxation. Let's dive deeper and understand all about SIP taxation.

Long Term Capital Gains- LTCG is applicable when the redemption is done after one year in case of equity funds and three years in case of debt and liquid funds.

Short Term Capital Gains- STCG takes place when the redemption is done before 12 months in case of equity and three years in case of debt funds.

| Type | Long Term Holding Period | Short Term Holding Period | Long Term Taxation | Short Term Taxation |

| Equity Term | 1 year | Less than 1 year | 10% if LTCG exceed ₹ 1 lakh. LTCG less than are exempt from taxation. | 15% if invested fot STCG |

| Debt Funds | 3 Year | Less than 3 year | 20% with indexation | As per individal Slab rate |

| International Funds | 3 Year | Less than 3 year | 20% with indexation. | as per individal Slab rate |

| Hybrid Funds | More than 65% of the portfolio invested in equity,taxtion will be same as equity fund or else taxed based on debt funds. | |||

Securities Transaction Tax (STT) - 0.01% is applicable on all equity funds

Health and education cess - 4% is applicable on all capital gains.

Surcharge (also known as an extra charge, it is, in essence, a tax imposed on a tax.) - if applicable will be added to the base tax

SIP taxation is different from lumpsum taxation. In lumpsum investment, tax is calculated by taking a single investment amount and date. Whereas in the case of SIP, tax is calculated by considering every investment made on every month.

Ram started an SIP of Rs 1,000 on January 01, 2020 for a period of 12 months. Now in January 2021, investment made by Ram in January 2020 will complete one year. The investment made in February 2020 will complete 11 months in January 2021 and so on. This means that Ram’s January investment will qualify for long term capital gain in January 2021 and remaining SIP tranches will fall under short term capital gain. SIP redemption process will take place on the FIFO (first in first out) model. It means units which are purchased first will be redeemed first.

Identify the type of investment.

Calculate the holding period and understand whether your investment falls under long term capital gain or small term capital gain.

Write down the amount at which you have purchased units and current selling NAV of the units.

Calculate the tax for each installment.

Ram invested ₹11,000 every month from September 1, 2020 to August 1, 2021 in an equity mutual fund scheme. Ram decided to withdraw ₹14,300 on December 1, 2021 and remaining amount will be redeemed on January 1, 2022. Let’s calculate the amount of tax he has to pay. Below is the investment made by Ram:

| Date | SIP Installment | NAV | Units |

| 01-Sep-20 | 11,000 | 10 | 1100 |

| 01-Oct-20 | 11,000 | 10.2 | 980.4 |

| 01-Nov-20 | 11,000 | 10.4 | 1057.7 |

| 01-Dec-20 | 11,000 | 10.6 | 1037.7 |

| 01-jan-21 | 11,000 | 10.8 | 1018.5 |

| 01-Feb-21 | 11,000 | 11 | 1000.0 |

| 01-Mar-21 | 11,000 | 11.2 | 982.1 |

| 01-Apr-21 | 11,000 | 11.4 | 964.9 |

| 01-may-21 | 11,000 | 11.6 | 948.3 |

| 01-jun-21 | 11,000 | 11.8 | 932.2 |

| 01-july-21 | 11,000 | 12 | 916.7 |

| 01-Aug-21 | 11,000 | 12.2 | 901.6 |

| Total Investment | 1,32,000 | Total Units | 11840.2 |

|---|

Redemption which take place:

| Date | NAV | Units | Redemption Amount |

| 01-Dec-21 | 13 | 1100 | 14300 |

| 01-jan-22 | 13.2 | 10740.2 | 141770.5 |

Calculation Capital Gain in the below table:

| Date | Units | NAV | Amount Invested | Redemption Date | Redemption NAV | Redemption Amount | Capital Gain (Redemption amount) | Holding Period | Capital Gain Category |

|---|---|---|---|---|---|---|---|---|---|

| 01-Sep-2020 | 1100 | 10 | 11,000 | December 1, 2021 | 13 | 14,300 | 3300 | 456 | LTCG |

| 01-Oct-2020 | 980.4 | 10.2 | 11,000 | January 1,2022 | 13.5 | 13235.4 | 2235 | 457 | LTCG |

| 01-Nov-2020 | 1057.7 | 10.4 | 11,000 | January 1,2022 | 13.5 | 14278.8 | 3279 | 426 | LTCG |

| 01-Dec-2020 | 1037.7 | 10.6 | 11,000 | January 1,2022 | 13.5 | 14009.4 | 3009 | 396 | LTCG |

| 01-Jan-2021 | 1018.5 | 10.8 | 11,000 | January 1,2022 | 13.5 | 13750 | 2750 | 365 | LTCG |

| 01-Feb-2021 | 1000 | 11 | 11,000 | January 1,2022 | 13.5 | 13500.0 | 2500 | 334 | STCG |

| 01-Mar-2021 | 982.1 | 11.2 | 11,000 | January 1,2022 | 13.5 | 13258.4 | 2259 | 306 | STCG |

| 01-Mar-2021 | 964.9 | 11.4 | 11,000 | January 1,2022 | 13.5 | 13026.2 | 2026 | 275 | STCG |

| 01-May-2021 | 948.3 | 11.6 | 11,000 | January 1,2022 | 13.5 | 12802.1 | 1802 | 245 | STCG |

| 01-Jun-2021 | 932.2 | 11.8 | 11,000 | January 1,2022 | 13.5 | 12584.7 | 1585 | 214 | STCG |

| 01-Jul-2021 | 916.7 | 12 | 11,000 | January 1,2022 | 13.5 | 12375.5 | 1375 | 184 | STCG |

| 01-Aug-2021 | 901.6 | 12.2 | 11,000 | January 1,2022 | 13.5 | 12171.6 | 1172 | 153 | STCG |

In the above table we see that on Dec 1, 2021 first redemption was done at the NAV of ₹13 and the total redemption amount is ₹14,300 this will come under long term capital gain because it has completed 365 days.

All other remaining SIP investment was redeemed on January 1, 2022 at the NAV of ₹13.5, SIP investment done on September 01, 2020 to January 01, 2021, will come under long term gain as they have completed 365 days.

All the investment done from 01, Feburary, 2021 till 01, Aug, 2021 will come under short term capital gain as their holding period is less than 365 days.

| Capital Gain Cate | Total Gains | Tax Payable | Reason |

| LTCG | 14,574 | 0 | Amount is lower than 1 lakh |

| STCG | 12,719 | 1907.83 | Taxed at 15% |

So, for long term capital gain Ram does not have to pay any tax as his total capital gains is below Rs 1 Lakh. In the case of short term capital gains, Ram has to pay 15% on his total gains of Rs ₹12,719, which is STCG tax of Rs 1,908.

This is how you calculate tax on your SIP investments.

A Systematic Investment Plan (or SIP) is a method of investing in which a fixed amount is debited from your bank account on a specific date.

The lock-in period in SIP is only applicable in ELSS mutual funds. In other category mutual funds, there is no lock-in period.

Yes, you can pause your SIP as and when you feel like it. No charges are taken for stopping the SIP.

You have an option to renew the SIP at the end of SIP. The AMC will normally send you a reminder to renew your SIP. You can decide whether to renew your SIP or not based on the returns generated by the fund during the SIP tenure.

While mutual fund companies do not penalise you for missing a few SIP instalments, if you miss three consecutive payments, your SIP will be instantly cancelled.

No, there is no extra hidden cost for starting an SIP.

If you have started a SIP in an open-ended equity or debt fund, then you can redeem from SIP anytime.

Fill in your personal details to begin your investment with Samco Mutual Fund

Mutual fund investments are subject to market risks, read all scheme related documents carefully.